Forex EA Settings Guides

IS PURPLE EA MT4: Complete Settings Guide

IS PURPLE EA MT4: Complete Settings Guide

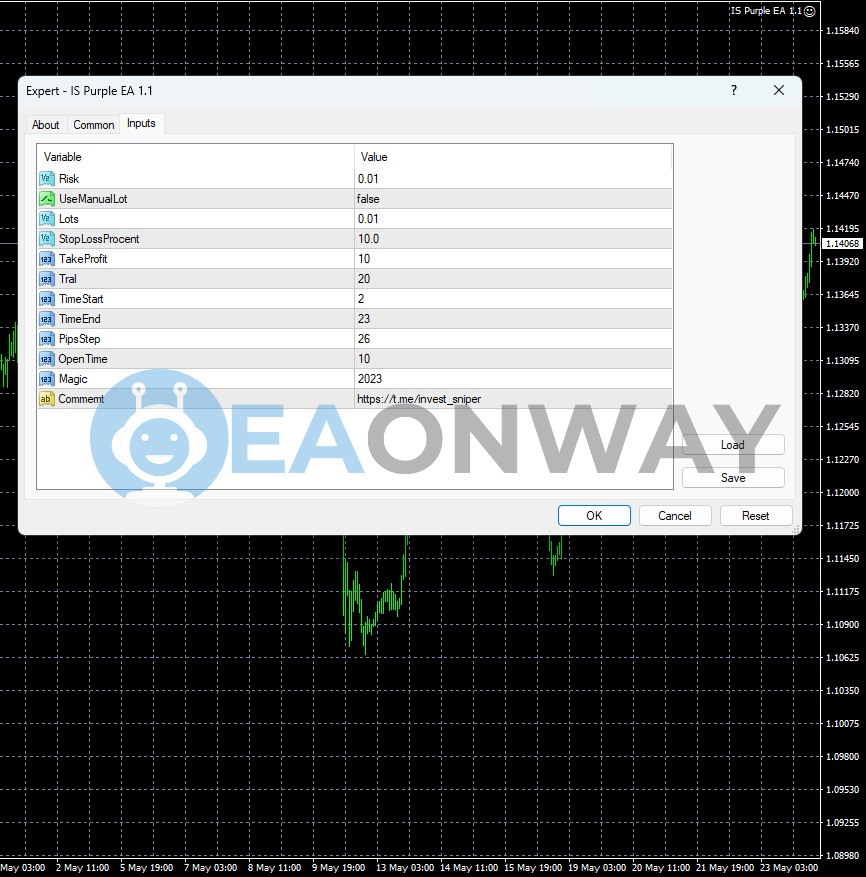

IS PURPLE EA MT4 is an automated Forex trading system designed for MetaTrader 4 that focuses on trading XAUUSD (Gold) and GBPUSD. This guide will help you understand and customize all input parameters to match your risk tolerance and trading preferences. The EA operates with predefined criteria for trade entries and exits, aiming to maximize profits while offering auto lot sizing for improved risk management.

Detailed Analysis of Input Settings of IS PURPLE EA MT4

IS PURPLE EA MT4’s parameters are grouped by function, including risk management, trade settings, time filters, order management, and identification.

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| Risk | Controls the auto lot sizing calculation based on account balance (when UseManualLot is false) | 0.01 | 0.01-0.05 (conservative), 0.05-0.1 (moderate) | Higher values increase position size and potential profit/loss |

| UseManualLot | Toggles between automatic lot calculation (false) or manual lot size (true) | false | false for dynamic risk management, true for fixed lot trading | When true, ignores Risk parameter and uses fixed Lots value |

| Lots | Fixed lot size used when UseManualLot is true | 0.01 | 0.01-0.1 for $500+ accounts, scale with balance | Direct impact on trade size when UseManualLot is true |

| StopLossProcent | Sets the stop loss as a percentage (likely of account balance) | 10.0 | 2.0-5.0 for conservative trading, 5.0-10.0 for moderate risk | Higher values allow larger drawdowns before closing positions |

| TakeProfit | Target profit in pips before closing a position | 10 | 8-25 depending on pair volatility | Lower values secure profits faster but may limit potential gains |

| Trail | Trailing stop distance in pips to lock in profits as price moves favorably | 10 | 5-15 pips | Smaller values lock profits more aggressively but risk earlier exit |

| TimeStart | Hour to begin trading (24-hour format, server time) | 2 | Adjust based on preferred market sessions (e.g., 7 for London) | Restricts trading to potentially more favorable market hours |

| TimeEnd | Hour to stop opening new trades (24-hour format, server time) | 23 | Adjust based on preferred market sessions (e.g., 16 for end of London) | Limits exposure during potentially unfavorable market hours |

| PipsStep | Distance in pips between consecutive orders, suggesting a grid-like approach | 26 | 15-30 for GBPUSD, 25-50 for XAUUSD | Smaller values create denser order placement, potentially increasing risk |

| OpenTime | Appears to control minimum time between new orders (likely in minutes) | 10 | 5-15 for average volatility, adjust higher during news events | Lower values may increase trade frequency and exposure |

| Magic | Unique identifier for the EA’s orders in the terminal | 2023 | Any unique number not used by other EAs (1000-99999) | No direct trading impact, used for order identification only |

| Comment | Text identifier attached to trades, currently set to developer’s Telegram | https://t.me/nvest_sniper | Any text (can be customized for your reference) |

Summary and Recommendations

- Use the Auto Lot feature (UseManualLot: false) with Risk values between 0.01-0.03 for safer trading.

- Start with minimum $500 account despite $100 minimum recommendation for better risk management.

- Optimal for XAUUSD and GBPUSD on M1 or M5 timeframes as designed by developer.

- Consider reducing StopLossProcent to 5.0 for more conservative risk exposure.

- Confirm your broker’s server time to ensure TimeStart and TimeEnd settings align with intended sessions.

- Use ECN or low-spread broker accounts as recommended for optimal performance.

- Test different PipsStep values based on the pair’s average daily range and volatility.

- Verify if TakeProfit and Trail values are in pips or points based on your broker platform.

- Avoid trading during major economic news releases that affect your chosen pairs.

- Consider starting with the provided preset files before making custom adjustments.

- Regularly monitor performance to identify needed parameter adjustments as market conditions change.

- Adjust OpenTime based on your pair’s typical volatility and price movement patterns.

Important Risk Warning

Forex trading and use of automated systems involve substantial risk of loss. Past results are not indicative of future performance, and many external factors can affect results. Users are solely responsible for proper installation, parameter configuration, and risk management after thorough testing. Neither the developer nor distributors guarantee profits or bear responsibility for trading losses. Always use proper risk management and only trade with capital you can afford to lose.

-

Swing killer EA MT4: Complete Settings Guide

-

The One EA MT4: Complete Settings Guide

-

Vibrix Group EA MT4: Complete Settings Guide

-

WallStreet Forex Robot EA MT4: Complete Settings Guide

-

Venom Ultra Sniper EA MT4: Complete Settings Guide

-

Hedge Scalper EA MT4: Complete Settings Guide

-

FFM PROPFIRM EA MT4: Complete Settings Guide

-

Forex ViP SMART SAFE TRADER EA MT4: Complete Settings Guide

-

AXL LITE EA MT4: Complete Settings Guide

-

NEO EA MT4: Complete Settings Guide

-

POSEIDON EA MT4: Complete Settings Guide

-

GOLD AVIATOR EA MT4: Complete Settings Guide