Forex EA Settings Guides

JORGEFX EA MT4: Complete Settings Guide

JorgeFX EA MT4: Complete Settings Guide

JorgeFX EA is an automated trading system designed for forex markets that combines scalping and trend-following strategies across multiple currency pairs. This guide helps you customize the EA’s parameters to match your trading style and risk tolerance. The EA employs sophisticated algorithms to analyze market conditions and execute trades while implementing robust risk management features.

You can find more details about the JorgeFX EA MT4 product here.

Detailed Analysis of Input Settings of JorgeFX EA MT4

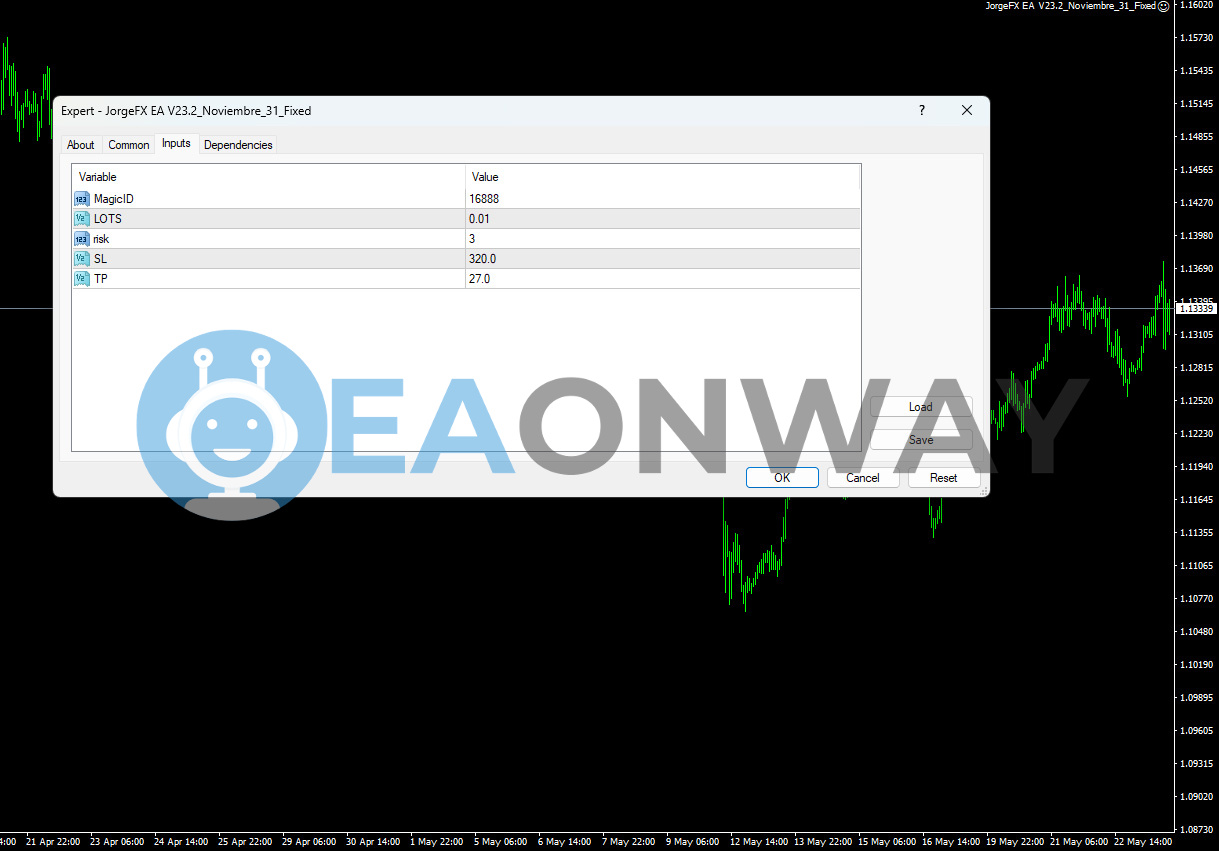

JorgeFX EA’s parameters are grouped by function to control trade identification, position sizing, and risk management elements.

Trade Identification and Control Settings

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| MagicID | Unique identifier number that distinguishes trades placed by this EA from other trades | 16888 | Any unique number between 10000-99999 | No impact on performance; ensures proper trade tracking |

Position Sizing and Risk Management Settings

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| LOTS | Fixed lot size for every trade regardless of account balance | 0.01 | 0.01-0.1 for $1000 accounts | Higher values increase both profit potential and risk exposure |

| Risk | Percentage-based risk per trade (likely calculates lot size based on account balance) | 3 | 0.5-2% for conservative approach | Higher values increase position sizes relative to account balance; values over 3% considered aggressive |

| SL (Stop Loss) | Maximum loss allowed per trade in points/pips before closing position | 320.0 | 50-150 pips recommended (if measured in pips) | Larger values reduce frequency of stopped trades but increase risk per trade; default is relatively high |

| TP (Take Profit) | Profit target in points/pips where the EA will close a profitable trade | 27.0 | 15-50 pips (assuming points); consider 1:1 to 1:2 risk-reward ratios | Smaller values lead to more frequent but smaller wins; default creates unfavorable risk-reward ratio |

Summary and Recommendations

- Start with minimal Risk setting (0.5-1%) instead of default 3% to preserve capital.

- Use on EURUSD, GBPUSD, USDCAD, USDJPY, EURGBP, AUDNZD, or AUDUSD as specified by developer.

- Consider adjusting the SL:TP ratio as default (320:27) creates approximately 12:1 risk-reward, which is highly unfavorable.

- Test thoroughly on demo accounts before live trading.

- Ensure stable, low-latency internet connection or VPS for scalping accuracy.

- Avoid running during major news events that can cause excessive slippage.

- Clarify with developer whether SL/TP values are in pips or points for proper risk assessment.

- Match lot size to your account balance (0.01 lots per $1000-2000 as a general guideline).

- Monitor initial trades closely to ensure settings perform as expected.

- Consider reducing default Stop Loss value significantly (to 100-150 points maximum).

Important Risk Warning

Forex trading carries substantial risk of loss and is not suitable for all investors. Past performance of JorgeFX EA does not guarantee future results. Market conditions, broker execution, and slippage can significantly impact EA performance. Users are solely responsible for proper installation, parameter configuration, and risk management. Always test thoroughly on a demo account first and never risk more than you can afford to lose.

-

Swing killer EA MT4: Complete Settings Guide

-

The One EA MT4: Complete Settings Guide

-

Vibrix Group EA MT4: Complete Settings Guide

-

IS PURPLE EA MT4: Complete Settings Guide

-

WallStreet Forex Robot EA MT4: Complete Settings Guide

-

Venom Ultra Sniper EA MT4: Complete Settings Guide

-

Hedge Scalper EA MT4: Complete Settings Guide

-

FFM PROPFIRM EA MT4: Complete Settings Guide

-

Forex ViP SMART SAFE TRADER EA MT4: Complete Settings Guide

-

AXL LITE EA MT4: Complete Settings Guide

-

NEO EA MT4: Complete Settings Guide

-

POSEIDON EA MT4: Complete Settings Guide