What Is Leverage In Forex Trading? Understanding The Power And Peril

Understanding what is leverage in Forex trading is absolutely fundamental before engaging with the currency markets, especially when considering automated tools like Expert Advisors (EAs). Have you ever wondered how it’s possible to control a large amount of currency with a relatively small amount of capital? This mechanism, known as leverage, is a defining feature of the Forex market, offering both significant opportunities and substantial risks that every aspiring trader must fully comprehend. It acts like a double-edged sword, capable of magnifying profits but equally potent in amplifying losses.

This article delves deep into the concept of Forex leverage. We will explore precisely how does leverage work in Forex, dissect leverage ratios, explain the critical relationship between leverage and margin Forex, and walk through practical Forex leverage examples. Crucially, we will emphasize the inherent risks of Forex leverage, equipping you with the knowledge to navigate leveraged trading responsibly and avoid the common pitfalls of unrealistic expectations, particularly when using automated systems. Our aim is to provide clear, objective information, helping you grasp the potential dangers before committing capital.

Key Takeaways on Forex Leverage

Here’s a quick summary of the essential points about Forex leverage:

- Definition: Leverage allows traders to control a larger position size in the Forex market than their own capital would normally permit, essentially borrowing funds from their broker.

- Amplification: It magnifies both potential profits and potential losses relative to the trader’s deposited margin.

- Margin: This is the collateral, or good faith deposit, required by the broker to open and maintain a leveraged position. It is not a fee.

- Double-Edged Sword: While leverage can enhance potential returns on capital, it dramatically increases risk. High leverage can lead to rapid and significant losses, potentially exceeding the initial deposit.

- Risk Management: Understanding and implementing robust risk management strategies (like stop-losses and appropriate position sizing) is non-negotiable when trading with leverage.

- Not a Free Lunch: Leverage does not change the underlying probability of a trade being successful; it only scales the outcome.

- Broker Dependency: Leverage levels vary between brokers and are often subject to regulatory restrictions depending on your location.

Understanding Forex Leverage: The Fundamentals

Leverage is a core concept in Forex trading, fundamentally altering the scale at which traders can participate in the market. Grasping its mechanics is the first step towards responsible trading.

What Exactly is Forex Leverage?

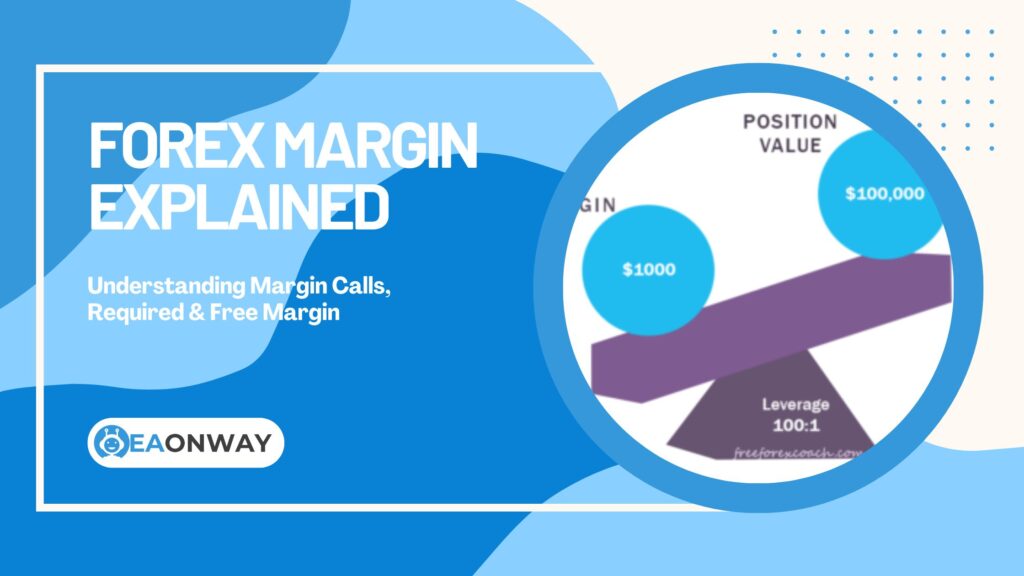

Forex leverage is essentially a loan provided by your broker, allowing you to open trading positions that are significantly larger than your own account balance. It’s expressed as a ratio, such as 1:50, 1:100, or even higher in some regions. This ratio indicates how much larger your trading position can be compared to the margin required to open it. For example, with 1:100 leverage, you can control a $100,000 position with just $1,000 of your own capital (the margin). This borrowed capital magnifies your exposure to market movements. Think of it as using a small amount of your money as a deposit to control a much larger asset value.

How Does Leverage Work in Forex Trading?

Leverage works by using a small amount of your capital, known as margin, as collateral to control a much larger contract size in the currency market. When you open a leveraged trade, your broker sets aside this margin amount from your account balance. You don’t actually borrow the full position value in the traditional sense; instead, the leverage ratio determines how much exposure you can get for that margin deposit. Any profits or losses are calculated based on the full size of the position you control, not just your margin amount. This is why even small percentage movements in the exchange rate can result in substantial gains or losses relative to your initial margin.

Why Do Forex Brokers Offer Leverage?

Forex brokers offer leverage primarily because the typical daily price movements in currency pairs are relatively small (often less than 1%). Without leverage, traders would need substantial capital to make potentially meaningful profits from these minor fluctuations. Offering leverage makes the Forex market accessible to a wider range of individuals with smaller starting capital. It also increases the potential trading volume for the broker, which is often how they generate revenue (through spreads or commissions). However, it’s crucial to remember that while leverage enables participation, it also significantly increases the inherent Forex risk management leverage challenges. Regulations in many jurisdictions, like those set by the European Securities and Markets Authority (ESMA), cap the maximum leverage offered to retail clients to mitigate excessive risk-taking (Source: ESMA Investor Protection Measures).

Leverage Ratios and Margin Explained

Understanding the numbers – the ratios and the margin requirements – is vital for managing leveraged trades effectively. They dictate the size of positions you can open and the buffer you have against losses.

What Are Forex Leverage Ratios?

A leverage ratio Forex represents the comparison between the total value of the transaction you control and the amount of your own capital (margin) required to open that transaction. It’s typically expressed as X:1.

- 1:50 Leverage: For every $1 of your margin, you can control $50 worth of currency.

- 1:100 Leverage: For every $1 of your margin, you can control $100 worth of currency.

- 1:200 Leverage: For every $1 of your margin, you can control $200 worth of currency.

- 1:500 Leverage: For every $1 of your margin, you can control $500 worth of currency.

Higher ratios mean you can control larger positions with less margin, but crucially, this also means your account is more sensitive to price movements, increasing the risk of significant losses or a margin call Forex event. Understanding the maximum leverage Forex offered by your broker and permitted by regulators is essential.

How is Forex Leverage Calculated?

While you usually select a leverage ratio offered by your broker, the underlying calculation relates the total position size to the required margin. The formula for the margin required based on a chosen leverage is:

Required Margin = Total Position Value / Leverage Ratio

For example:

You want to trade one standard lot of EUR/USD ($100,000 worth of currency).

Your broker offers 1:100 leverage.

Required Margin = $100,000 / 100 = $1,000.

So, you need $1,000 in your account as margin to open this $100,000 position. Conversely, if you know the margin used and the position size, you can determine the effective leverage you employed for that specific trade. The Forex leverage calculation itself is simple, but its implications are profound.

What is Margin in Forex Trading?

Forex margin is not a transaction fee or cost. It is a portion of your account equity set aside and held in good faith by your broker as collateral when you open a leveraged trading position. It ensures you have sufficient funds to cover potential losses. Think of it as a security deposit. The amount of margin required depends on the leverage ratio you are using and the size of the position you want to open. Higher leverage means a lower required margin Forex percentage for the same position size, but the risk remains tied to the full position size.

How Are Leverage and Margin Connected?

Leverage and margin Forex are two sides of the same coin; they have an inverse relationship.

- Higher Leverage Ratio = Lower Margin Requirement (as a percentage of position size).

- Lower Leverage Ratio = Higher Margin Requirement (as a percentage of position size).

For instance, opening a $100,000 position:

- With 1:50 leverage, requires $2,000 margin (2%).

- With 1:100 leverage, requires $1,000 margin (1%).

- With 1:500 leverage, requires $200 margin (0.2%).

While lower margin requirements with high leverage might seem attractive, allowing you to control large positions with minimal capital outlay, it dramatically reduces your buffer against adverse market movements. A small price change against your position can quickly erode your account equity, leading to a margin call.

What is Required Margin vs. Free Margin?

Understanding the different types of margin displayed in your trading platform is crucial:

- Required Margin (Used Margin): This is the total amount of your account equity currently locked up as collateral for all your open positions. As calculated above, it depends on the size of your trades and the leverage used.

- Free Margin: This is the amount of money remaining in your trading account that is available to open new positions or to absorb losses from existing positions. It is calculated as: Free Margin = Equity – Required Margin.

- Equity: This is the real-time value of your account, calculated as: Equity = Account Balance + Unrealized Profits/Losses.

Monitoring your free margin is critical. If your open positions move against you, your equity decreases, and consequently, your free margin shrinks.

What Happens During a Margin Call?

A margin call Forex occurs when your account equity falls below a certain required level, known as the maintenance margin level (which is typically a percentage of the required margin, set by the broker). Essentially, your free margin becomes zero or negative, meaning you no longer have sufficient funds to support your open leveraged positions.

When a margin call happens:

- Notification: Your broker will typically notify you (though it’s your responsibility to monitor your account).

- Demand: You will be required to either deposit additional funds into your account to bring the equity back above the maintenance margin level OR close some or all of your open positions to reduce the required margin.

- Forced Liquidation (Stop Out): If you fail to meet the margin call requirements promptly, the broker has the right (and usually automated systems in place) to forcibly close out your positions, starting with the least profitable ones, to prevent further losses and bring your account back into compliance. This happens at the prevailing market price, which could lock in substantial losses. Margin calls are a direct and often painful consequence of excessive trading with leverage.

The Double-Edged Sword: Benefits and Risks of Leverage

Leverage is often marketed for its benefits, but its risks are far more critical to understand for long-term survival in trading. It amplifies everything – the good and the bad.

What Are the Potential Benefits of Using Forex Leverage?

While emphasizing the risks is paramount, leverage does offer potential advantages when used cautiously and correctly:

- Magnified Profit Potential: The primary allure of leverage is its ability to generate potentially larger profits from relatively small capital investments. A small favorable price movement can translate into a significant percentage gain on your margin.

- Capital Efficiency: Leverage allows traders to control larger positions than their capital would otherwise allow, freeing up capital for other trades or investments (though this should be approached with extreme caution to avoid over-exposure).

- Access to Markets: It lowers the barrier to entry for the Forex market, allowing traders with limited capital to participate.

- Trading Opportunities: The ability to take larger positions can enable traders to capitalize on smaller price fluctuations that might otherwise be insignificant.

These benefits of Forex leverage must always be weighed against the equally magnified risks.

What Are the Significant Risks of High Leverage Forex Trading?

The risks associated with Forex leverage, especially high leverage Forex trading, are substantial and can lead to rapid financial loss if not managed properly. These risks of Forex leverage include:

- Amplified Losses: Just as profits are magnified, losses are equally amplified. A small adverse price movement can result in losses that significantly exceed your initial margin, potentially wiping out your entire account balance quickly. Between 70-85% of retail traders lose money trading CFDs (which heavily involve leverage), as reported by several sources including Investopedia (Source: Investopedia).

- Increased Risk of Margin Calls: High leverage leaves very little room for error. Even minor market volatility against your position can rapidly deplete your free margin, triggering a margin call and potential forced liquidation of your trades at a loss.

- Potential for Negative Balance (in some cases): While many regulated brokers offer negative balance protection (meaning you cannot lose more than your deposited funds), this isn’t universal. In jurisdictions without it, or with certain account types, it’s theoretically possible to owe the broker money if losses exceed your account balance during extreme market events.

- Psychological Pressure: Trading large positions relative to your capital can induce significant stress, fear, and greed, leading to poor decision-making (e.g., closing winning trades too early, holding losing trades too long).

- False Sense of Security: Using high leverage might make traders feel they have more “buying power,” potentially leading them to overtrade or take excessively large positions relative to a sound risk management plan.

Forex Leverage Example: Seeing it in Action

Let’s illustrate the impact of leverage with a simplified Forex leverage example. Assume you have $2,000 in your trading account.

Scenario 1: Trading WITHOUT Leverage (or 1:1 Leverage)

- You decide to buy EUR/USD. With $2,000, you can control a position size of roughly €2,000 (ignoring spreads for simplicity).

- Let’s say the EUR/USD price moves up by 1% (e.g., from 1.1000 to 1.1110).

- Your profit would be 1% of €2,000 = €20 (or approximately $22).

- If the price moves down by 1%, your loss would be €20 (or approximately $22).

Scenario 2: Trading WITH 1:100 Leverage

- With $2,000 equity and 1:100 leverage, your broker might allow you to control a position size of up to $200,000 (though prudent risk management would advise against using the maximum). Let’s say you decide to open a position of $100,000 (one standard lot), requiring $1,000 margin.

- The EUR/USD price moves up by 1%.

- Your profit is calculated on the full $100,000 position size: 1% of $100,000 = $1,000. This represents a 50% gain on your initial $2,000 account balance (or 100% gain on the $1,000 margin used).

- BUT, if the EUR/USD price moves down by 1%.

- Your loss is calculated on the full $100,000 position size: 1% of $100,000 = $1,000. This represents a 50% loss of your initial $2,000 account balance.

- If the price moves down by 2%, your loss would be $2,000, potentially wiping out your entire account and triggering a margin call/stop out even before reaching the full 2% move, depending on the maintenance margin level.

This example clearly demonstrates how leveraged trading dramatically amplifies both potential outcomes.

Practical Considerations for Using Leverage

Choosing and managing leverage requires careful thought and alignment with your trading strategy and risk tolerance. It’s not about maximizing exposure but optimizing risk-reward based on your circumstances.

How Much Leverage Should You Use?

There is no single “correct” amount of leverage. The appropriate level depends heavily on:

- Risk Tolerance: How much of your capital are you willing to risk per trade? Conservative traders use very low effective leverage.

- Trading Strategy: Strategies with high win rates but small profit targets might tolerate slightly higher leverage than strategies aiming for large wins but with lower win rates. Volatility also plays a key role.

- Experience Level: Beginners should always start with very low leverage (or even a demo account) to understand the dynamics without significant financial risk.

- Market Conditions: Higher volatility generally warrants lower leverage.

Crucially, you should never use the maximum leverage Forex brokers offer just because it’s available. Focus on controlling your risk per trade through position sizing, regardless of the maximum leverage cap. Many experienced traders use effective leverage far below the maximum offered by their Forex broker leverage settings.

What is the Best Leverage for Forex Beginners?

For beginners, the best leverage for Forex beginners is undoubtedly low leverage. Starting with ratios like 1:10, 1:20, or an absolute maximum of 1:50 is highly recommended.

Why?

- Learning Curve: It allows you to learn the mechanics of trading, understand market movements, and experience wins and losses without the risk of catastrophic account depletion from minor errors or adverse moves.

- Risk Management Focus: Low leverage forces a greater focus on sound risk management principles like position sizing and stop-loss placement, which are essential for long-term success.

- Reduced Psychological Stress: Smaller potential losses associated with lower leverage reduce emotional pressure, allowing for more rational decision-making.

Starting with high leverage as a beginner is one of the fastest ways to lose your trading capital. Prioritize capital preservation and learning over chasing unrealistic profits.

How Do Forex Broker Leverage Offerings Differ?

Leverage offerings vary significantly between brokers based on several factors:

- Regulation: Regulatory bodies in different jurisdictions often impose strict limits on the maximum leverage brokers can offer retail clients. For example, ESMA (Europe) typically caps major Forex pairs at 1:30, while ASIC (Australia) has similar restrictions. Other regions might allow much higher leverage (e.g., 1:500 or more), often associated with offshore brokers, which may carry additional risks. (Source: ASIC Product Intervention Order – CFDs)

- Account Type: Brokers may offer different leverage levels for standard, ECN, or professional accounts (which often have higher capital requirements and assume clients understand the risks).

- Asset Class: Leverage often differs for Forex pairs (majors vs. minors vs. exotics), commodities, indices, or cryptocurrencies.

- Broker Policy: Even within regulatory limits, brokers set their own policies, sometimes offering lower maximum leverage as a risk management measure.

Always check the specific leverage conditions offered by your chosen broker for your account type and region.

Is High Leverage Necessary for Forex EAs?

A common misconception, especially among those new to automated trading, is that high leverage Forex trading is essential for Forex Expert Advisors (EAs) to be profitable. This is generally false and dangerous.

While an EA automates trade execution based on its algorithm, it does not eliminate the risks of leverage. An EA operating with high leverage is just as susceptible—if not more so, due to its potential speed and frequency of trading—to amplified losses and margin calls as a manual trader.

The perceived profitability of an EA should stem from its underlying strategy, logic, and risk management parameters, not from simply applying excessive leverage. Using high leverage with an EA can quickly turn a potentially viable strategy into a rapid account destroyer during unexpected market volatility or a losing streak. Responsible EA usage involves setting appropriate leverage levels and robust risk controls within the EA’s parameters (like stop-loss per trade, maximum drawdown limits, etc.). Relying on high leverage rather than a sound strategy is a recipe for failure.

Managing Risk When Trading with Leverage

Given the amplified loss potential, effective risk management isn’t just advisable when using leverage – it’s absolutely critical for survival.

Why is Risk Management Crucial with Leveraged Trading?

Risk management is paramount because leverage magnifies losses at the same rate it magnifies potential gains. Without strict controls, a few losing trades, even with small price movements against you, can cripple your trading account when high trading with leverage is employed. Effective Forex risk management leverage strategies aim to protect your capital, limit losses on individual trades, and ensure you can continue trading even after experiencing inevitable drawdowns. It shifts the focus from chasing maximum profits to preserving capital first.

How Can You Manage Leverage Risk Effectively?

Several techniques are essential for managing the risks of leveraged trading:

- Use Stop-Loss Orders: Always place a stop-loss order for every trade. This pre-defines the maximum amount you are willing to lose on a single position, automatically closing the trade if the price reaches that level.

- Appropriate Position Sizing: This is arguably the most critical risk management tool. Calculate your position size based on a small, fixed percentage of your account equity you’re willing to risk per trade (e.g., 1-2%), considering your stop-loss distance. Do not simply trade the maximum position your leverage allows.

- Choose Lower Leverage: Opt for lower leverage ratios offered by your broker (e.g., 1:50 or 1:100 instead of 1:500), especially if you are a beginner or have a lower risk tolerance. Even if higher leverage is available, consciously choose to use less.

- Understand Margin Requirements: Continuously monitor your used margin and free margin levels to ensure you have a sufficient buffer against adverse market movements and avoid margin calls.

- Avoid Over-Trading: Opening too many positions simultaneously, even if individually small, can quickly increase your overall risk exposure and margin requirements.

- Know Your Strategy’s Limits: Understand the historical drawdown and risk characteristics of your trading strategy (manual or automated) and ensure your leverage and risk per trade align with these characteristics.

- Continuous Education: Stay informed about market dynamics, risk management techniques, and the specific risks associated with the instruments you trade.

Final Thoughts on Forex Leverage

Leverage is an integral part of the Forex market, a powerful tool that allows traders to amplify their market exposure. We’ve explored what is leverage in Forex trading, how it interconnects with Forex margin, the mechanics of how does leverage work in Forex, and the critical importance of understanding Forex leverage ratios and calculations.

However, the key takeaway must be the dual nature of this tool. While the benefits of Forex leverage include increased potential returns and capital efficiency, the risks of Forex leverage, particularly high leverage Forex trading, are immense. Amplified losses, the threat of margin calls, and the potential for rapid account depletion are ever-present dangers. Success in leveraged trading hinges not on maximizing leverage, but on implementing disciplined Forex risk management leverage strategies, including careful position sizing and the consistent use of stop-losses. Whether trading manually or using Forex EAs, approach leverage with respect, caution, and a thorough understanding of its potential consequences to avoid unrealistic expectations and protect your capital.

Important Risk Warning

The information provided in this article is for educational purposes only and should not be considered investment advice or a recommendation to trade Forex or use leverage. Forex trading, especially when using leverage, involves a significant risk of loss and is not suitable for all investors. You should carefully consider your investment objectives, level of experience, and risk appetite before deciding to trade. There is a possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Past performance is not indicative of future results. Be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. EaOnWay.com does not provide investment advice and is not responsible for any trading losses incurred.