Forex EA Settings Guides

MEKAMAINA EA MT4: Complete Settings Guide

MEKAMAINA EA MT4: Complete Settings Guide

MEKAMAINA EA MT4 is an AI-powered forex trading robot designed to help traders pass prop firm challenges and achieve consistent profitability. This guide provides detailed instructions for customizing the EA’s parameters to match your trading style and risk tolerance. The EA utilizes advanced algorithms to analyze market conditions while implementing dynamic risk management strategies.

You can find more details about the MEKAMAINA EA 2.0 MT4 product here.

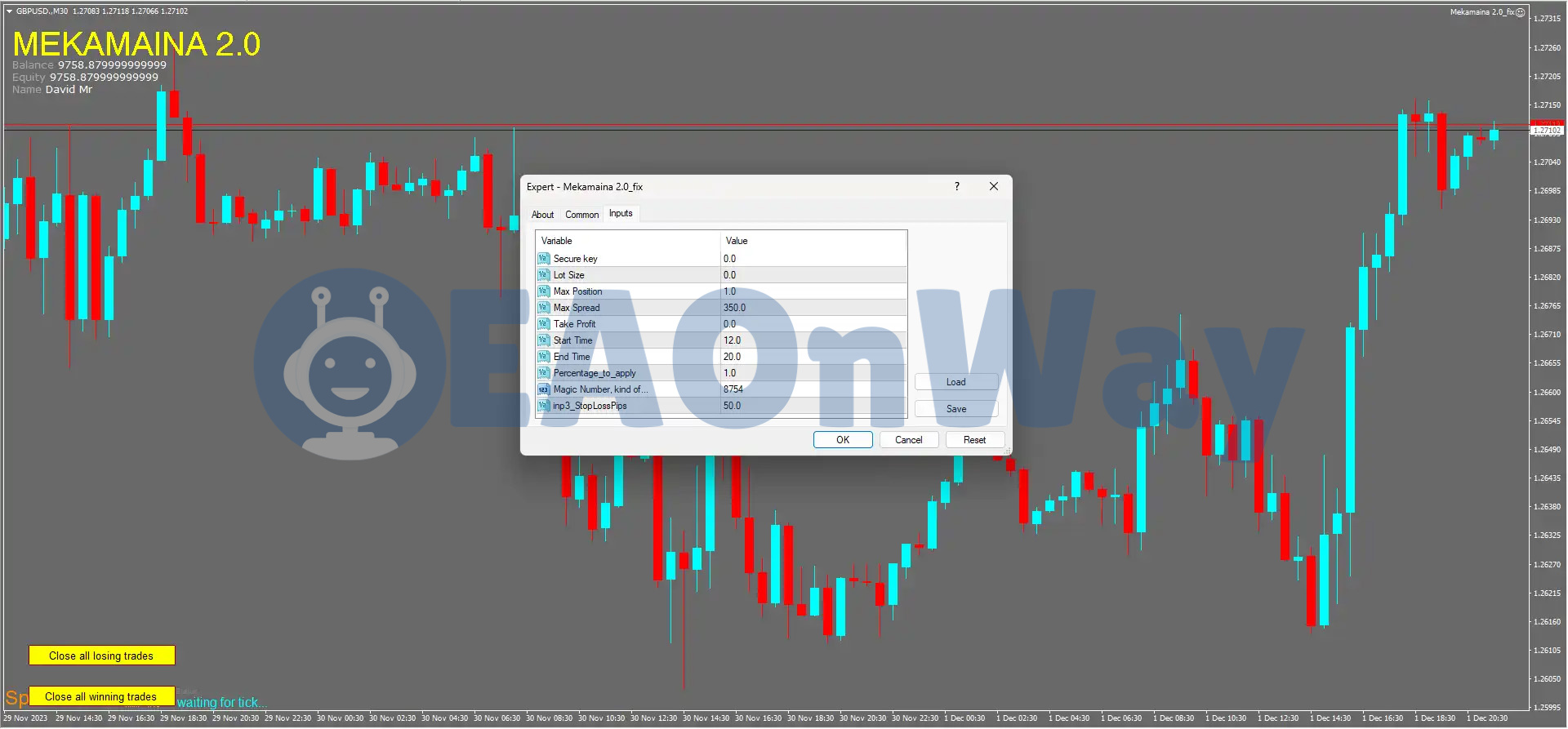

Detailed Analysis of Input Settings of MEKAMAINA EA MT4

The parameters of MEKAMAINA EA MT4 are organized into functional groups for easier configuration, including trade execution, risk management, time settings, and technical identifiers.

Trade Execution Settings

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| Max Spread | Sets the maximum allowed spread for opening trades | 350.0 | 5.0-20.0 for major pairs | Higher values allow trading in more volatile conditions but may increase costs |

| Lot Size | Determines the volume for each trade | 1.0 | 0.01-0.1 for $1,000 accounts | Directly impacts risk exposure; higher values mean higher risk |

| Max Position | Limits the maximum number of concurrent positions | 1.0 | 1-3 for conservative approach | Higher values increase potential profit but also risk |

Risk Management Parameters

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| Stop Loss Pips | Sets the fixed stop loss distance in pips | 50.0 | 30-100 depending on pair volatility | Smaller values reduce risk per trade but may increase likelihood of being stopped out |

| Percentage_to_apply | Controls risk percentage adjustment factor | 1.0 | 0.5-2.0 | Higher values increase risk/reward profile |

| Take Profit | Defines profit target in pips | Not specified | 1.5-2× Stop Loss value | Determines profit target; affects risk-reward ratio |

Time Settings

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| Start Time | Hour when EA begins trading (server time) | 12.0 | Align with New York session (13:00-21:00 GMT) | Restricts trading to specific market hours |

| End Time | Hour when EA stops trading (server time) | 20.0 | Align with New York session close | Prevents trading during less favorable periods |

Technical Identifiers

| Parameter Name | Description | Default Value | Range/Recommended Values | Impact |

|---|---|---|---|---|

| Magic Number | Unique identifier for EA trades | 8754 | Any unique number | Allows EA to identify its own trades; changing prevents management of existing trades |

| Secure Key | Security verification value | 0.0 | Use developer-provided value | Required for EA activation |

Summary and Recommendations

• Reduce default Lot Size to 0.01-0.1 per $1,000 of account balance for safer risk management.

• Test the EA with EURUSD during New York session hours for optimal performance.

• Confirm server time settings to ensure trading window aligns with desired market sessions.

• Reduce Max Spread from default 350.0 to 10-20 pips for major pairs to control trading costs.

• Keep Max Position at 1.0 initially until EA performance is verified.

• Use a low-latency VPS like MyfxVPS.com as recommended by the developer.

• Avoid changing Magic Number after deployment to prevent orphaned trades.

• Consider Exness or HTFX brokers as suggested by the developer for optimal compatibility.

• Back-test any parameter changes before applying to live trading.

• Verify whether Stop Loss is in pips or points before setting values.

• Maintain Take Profit at 1.5-2× the Stop Loss value for favorable risk-reward ratio.

Important Risk Warning

Forex trading involves substantial risk of loss. Past results do not guarantee future performance of this EA. Market conditions change constantly, affecting the EA’s performance. Users are solely responsible for implementing proper risk management, thoroughly testing the EA before live trading, and monitoring its operation. The developer provides no guarantees of profit and bears no responsibility for any trading losses incurred.

-

Swing killer EA MT4: Complete Settings Guide

-

The One EA MT4: Complete Settings Guide

-

Vibrix Group EA MT4: Complete Settings Guide

-

IS PURPLE EA MT4: Complete Settings Guide

-

WallStreet Forex Robot EA MT4: Complete Settings Guide

-

Venom Ultra Sniper EA MT4: Complete Settings Guide

-

Hedge Scalper EA MT4: Complete Settings Guide

-

FFM PROPFIRM EA MT4: Complete Settings Guide

-

Forex ViP SMART SAFE TRADER EA MT4: Complete Settings Guide

-

AXL LITE EA MT4: Complete Settings Guide

-

NEO EA MT4: Complete Settings Guide

-

POSEIDON EA MT4: Complete Settings Guide