-98%

AXL LITE EA MT4 with Setfiles

Original price was: $1,999.00.$39.99Current price is: $39.99.

AXL LITE EA MT4: Prop firm tested forex robot with 82% win rate and -0.70% max drawdown. Multi-strategy MACRO signals across 7 timeframes for consistent trading.

✓

Verified Original & Safe

✓

Instant Download After Purchase

✓

Free Updates for Future Versions

✓

Free Dedicated Remote Support

✓

Unlimited Activations on Your Accounts

✓

Money-Back Guarantee (Details)

Secure Checkout

Table of Contents

What is AXL LITE EA?

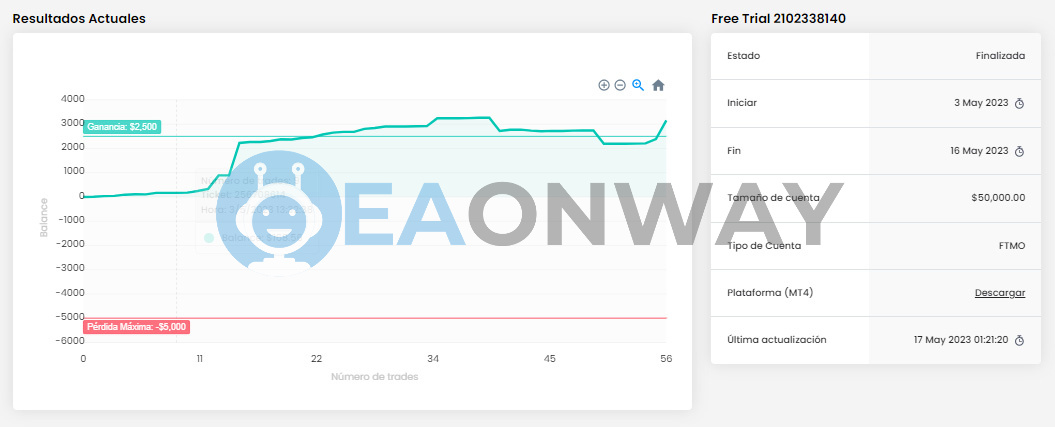

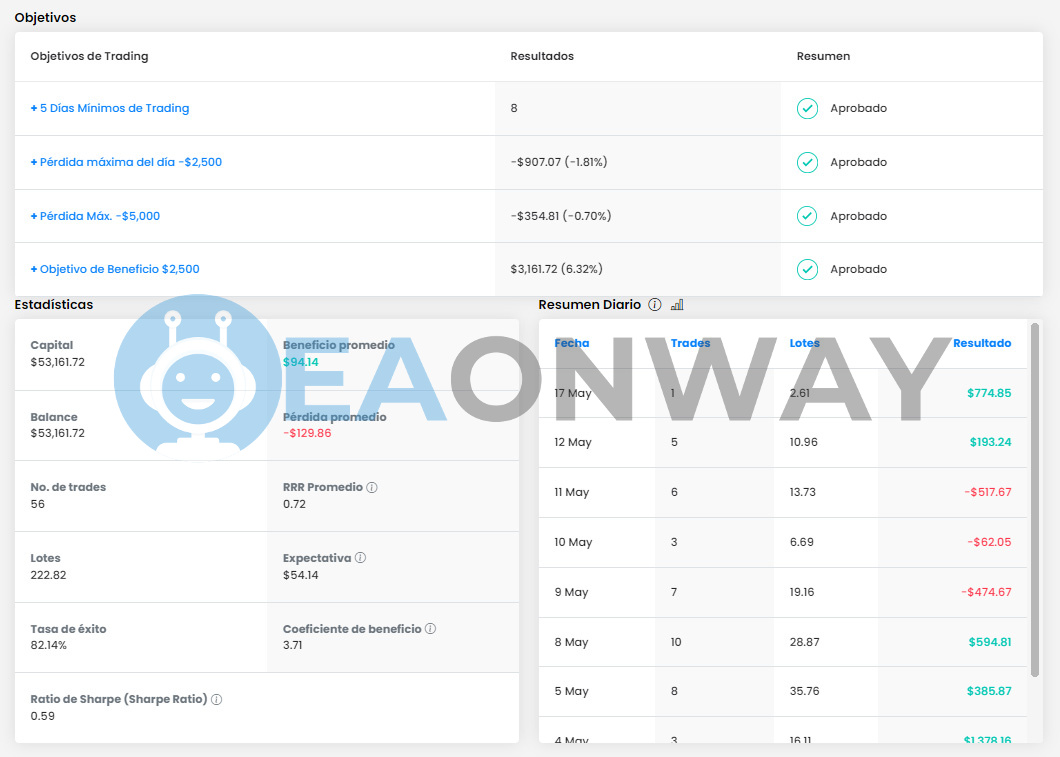

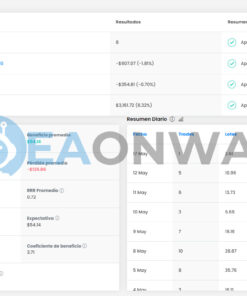

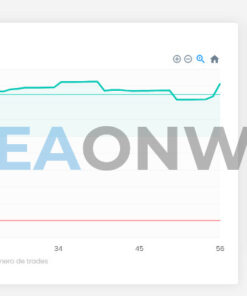

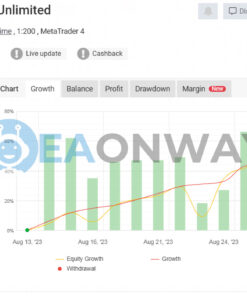

AXL LITE EA is a specialized forex expert advisor engineered specifically for prop trading firm challenges and long-term account growth through advanced algorithmic trading. This automated system achieved remarkable results in live FTMO testing, generating $3,161.72 profit (6.32% return) while maintaining just -0.70% maximum drawdown across 56 trades. The EA combines multi-timeframe MACRO signal analysis with sophisticated risk management to deliver consistent performance for professional traders.

Key Takeaway

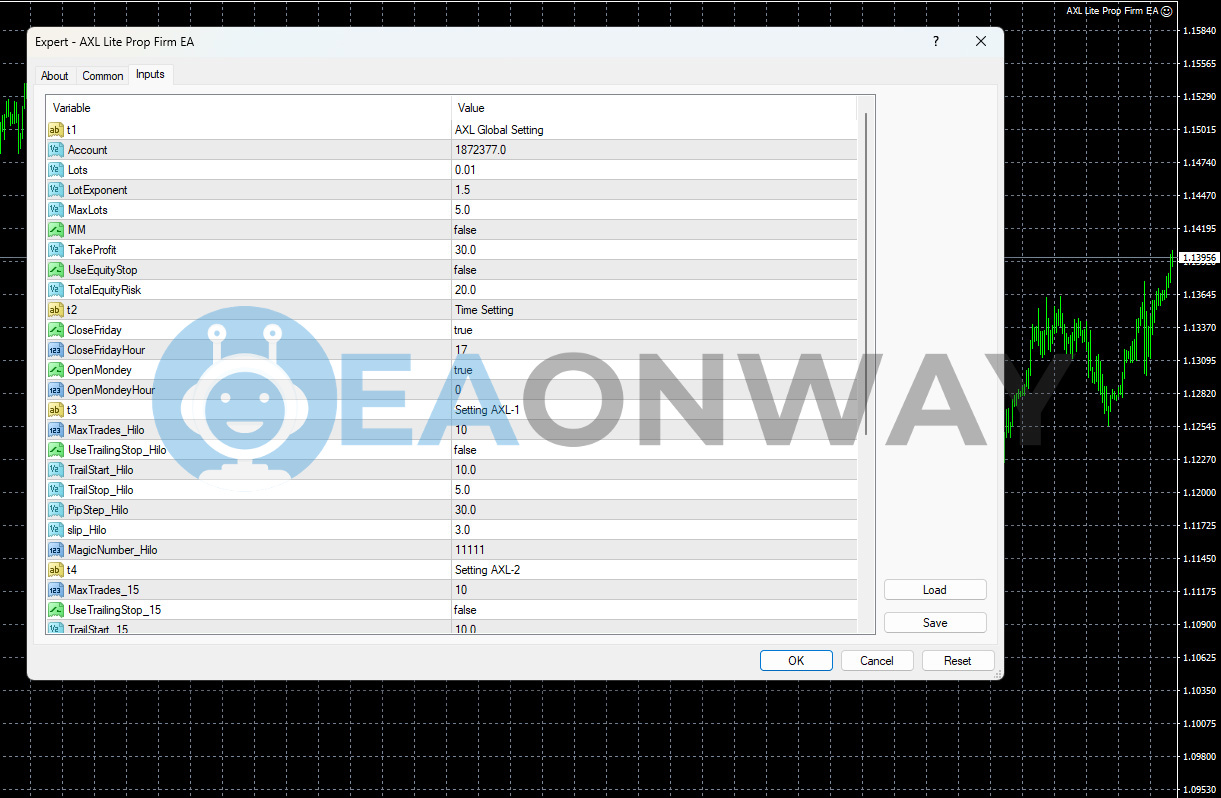

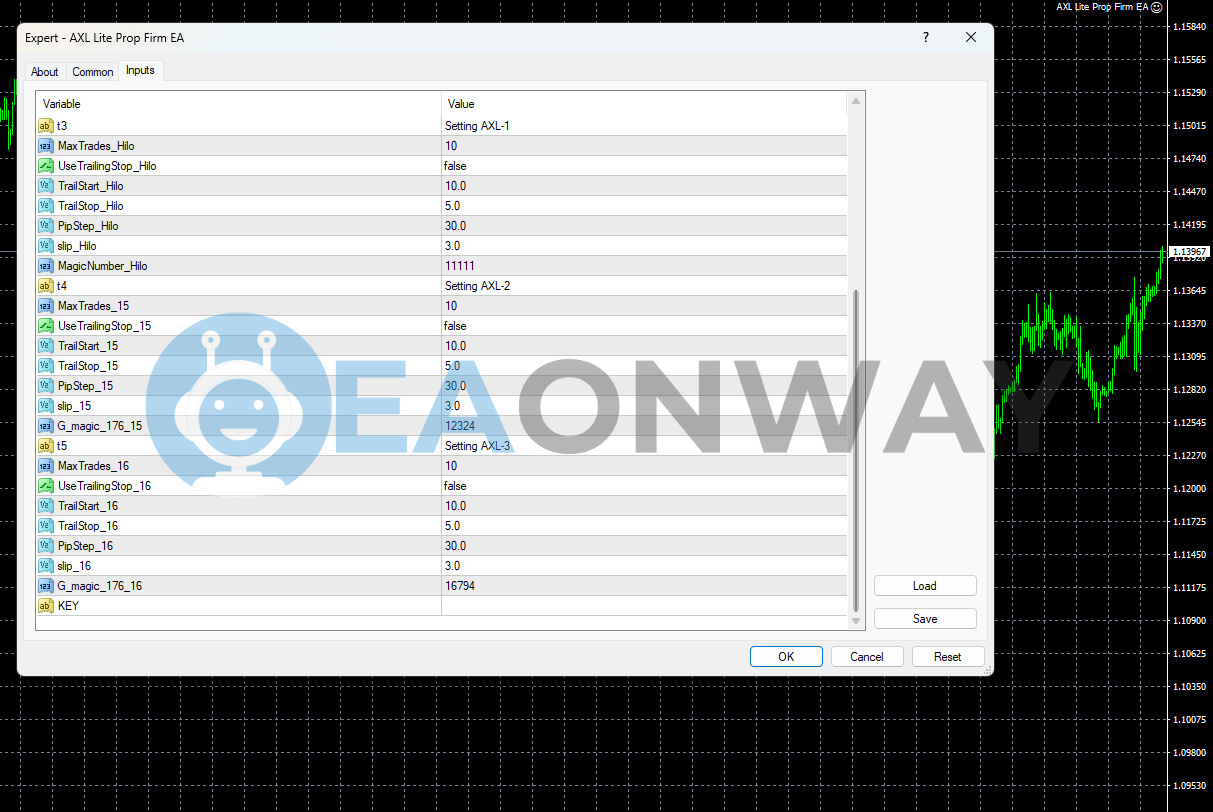

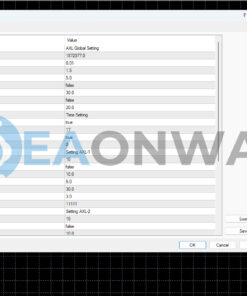

• Core Trading Strategy: Utilizes proprietary MACRO signal technology active across seven timeframes (M1 to D1) combined with three distinct algorithmic settings (AXL-1 Hilo logic, AXL-2 _15 logic, AXL-3 _16 logic) for comprehensive market analysis and trade execution

• Multi-Component System: Features intelligent position management with PipStep recovery mechanism (30-pip intervals), lot exponential scaling (1.5x multiplier), and individual MaxTrades limits per strategy component to balance opportunity with controlled risk exposure

• Verified Performance: Achieved 82.14% win rate with 3.71 profit coefficient in live prop firm testing, though the recovery-style approach with lot exponent scaling carries inherent drawdown risks during sustained adverse price movements

• Advanced Risk Management: Integrates dynamic money management, equity stop protection (configurable), take profit targeting (30 pips), and weekend gap avoidance through time-based trade filtering – but users must understand grid-style recovery mechanisms can amplify losses in trending markets

• Prop Firm Optimization: Successfully passed FTMO challenge requirements including maximum daily loss limits (-$2,500) and total loss constraints (-$5,000), though strategy performance may vary significantly in longer-term live trading environments outside evaluation parameters

• Primary Risk Consideration: The combination of lot exponential scaling and pip-step recovery creates potential for rapid account growth but also substantial drawdown risk if multiple strategy components enter recovery phases simultaneously during strong trending conditions

Recommendations for AXL LITE EA

• Trading Platform: MetaTrader 4 (MT4) – confirmed compatibility with full feature access

• Currency Pairs: GBPUSD (verified in live testing) – other major pairs may be supported but require individual testing for optimal performance

• Supported Accounts: ECN and standard accounts compatible – ECN recommended for tighter spreads due to frequent trade execution patterns

• Timeframe: H1 (hourly) primary operational timeframe, though MACRO signal analyzes M1 through D1 for comprehensive market context

• Trading Time: Includes weekend gap protection with Friday 17:00 close and Monday morning restart functionality

• Leverage: Moderate leverage recommended (1:100 to 1:200) – higher leverage amplifies both profit potential and drawdown risks, especially given the EA’s recovery mechanisms

• Minimum Deposit: $10,000+ recommended for proper risk management – while EA can operate on smaller accounts, larger capital provides better cushion for grid-style recovery sequences and prop firm challenge requirements

For detailed setup instructions and to optimize its performance, please refer to our comprehensive settings guide for the AXL LITE EA.

AXL LITE EA Review

AXL LITE EA demonstrates strong prop firm compatibility with verified 82.14% win rate and controlled drawdown execution, though its grid-recovery approach requires careful capital management and market condition awareness for sustainable long-term performance.

Live FTMO Challenge Results: Successfully generated $3,161.72 profit (6.32% return) with maximum drawdown of only -$354.81 (-0.70%), completing 56 trades over 8 trading days while respecting all prop firm risk parameters.

Technical Performance Snapshot: Achieved 3.71 profit coefficient with $94.14 average winning trade versus -$129.86 average loss, demonstrating effective risk-reward management despite slightly negative individual trade ratio through volume-based profitability approach.

Why Choose AXL LITE EA

• Proven Prop Firm Success: Unlike theoretical backtests, this EA has documented live FTMO challenge completion with actual profit generation – however, prop firm environments differ from long-term live trading, requiring ongoing performance monitoring

• Multi-Strategy Architecture: Three distinct algorithmic components (AXL-1, AXL-2, AXL-3) provide diversified market approach and reduced single-strategy dependency – though multiple active strategies can also multiply risk exposure during adverse market conditions

• Intelligent Risk Controls: Features comprehensive money management with equity stops, lot scaling limits, and time-based filters – but users must properly configure these parameters as default settings may not suit all account sizes or risk tolerances

• Transparent Recovery Mechanism: Clear pip-step and lot exponent parameters allow users to understand and customize the EA’s position averaging approach – while providing control, this strategy type requires sufficient capital and careful market timing

• Professional-Grade Development: MACRO signal technology and multi-timeframe analysis demonstrate sophisticated market reading capabilities beyond simple indicator-based systems – though complex algorithms may be harder to troubleshoot or modify for specific trading preferences

Conclusion

AXL LITE EA offers genuine prop firm compatibility with verified performance results, making it suitable for challenge-focused traders with adequate capital and grid-strategy understanding, while requiring caution from traders inexperienced with recovery-based systems or those with limited account balances.

Get AXL LITE EA now!

• Telegram: https://t.me/+E2r7ipeuS6BjNzFl

• Email: [email protected]

• Website: eaonway.com

AXL LITE EA MT4 Download Packages:

- Link download experts:

- AXL LITE EA MT4.ex4

- Presets:

- LOW RISK.set

FAQs

What is AXL LITE EA MT4 and who is it for?

What trading strategy does the AXL LITE EA MT4 use?

Is there proof of its performance, like live results?

Does this EA use risky techniques like Grid or Martingale?

What is the minimum deposit recommended to use this EA?

Which trading platform and currency pairs are best for it?

What are the main risks I should be aware of when using it?

How does it manage risk, and can I adjust the settings?

What leverage and timeframe are recommended for operating this EA?

Are specific .set files provided with the EA, or is setup based on a guide?

Reviews

There are no reviews yet.