-96%

FXFUNDINGMATE PROPFIRM EA MT4 V2.0 with Setfiles

Original price was: $899.00.$39.99Current price is: $39.99.

FXFUNDINGMATE PROPFIRM EA: Proven prop firm challenge success with 103% profit target achievement and 2% drawdown protection. MT4 automated trading system.

✓

Verified Original & Safe

✓

Instant Download After Purchase

✓

Free Updates for Future Versions

✓

Free Dedicated Remote Support

✓

Unlimited Activations on Your Accounts

✓

Money-Back Guarantee (Details)

Secure Checkout

Table of Contents

What is FXFUNDINGMATE PROPFIRM EA 2.0?

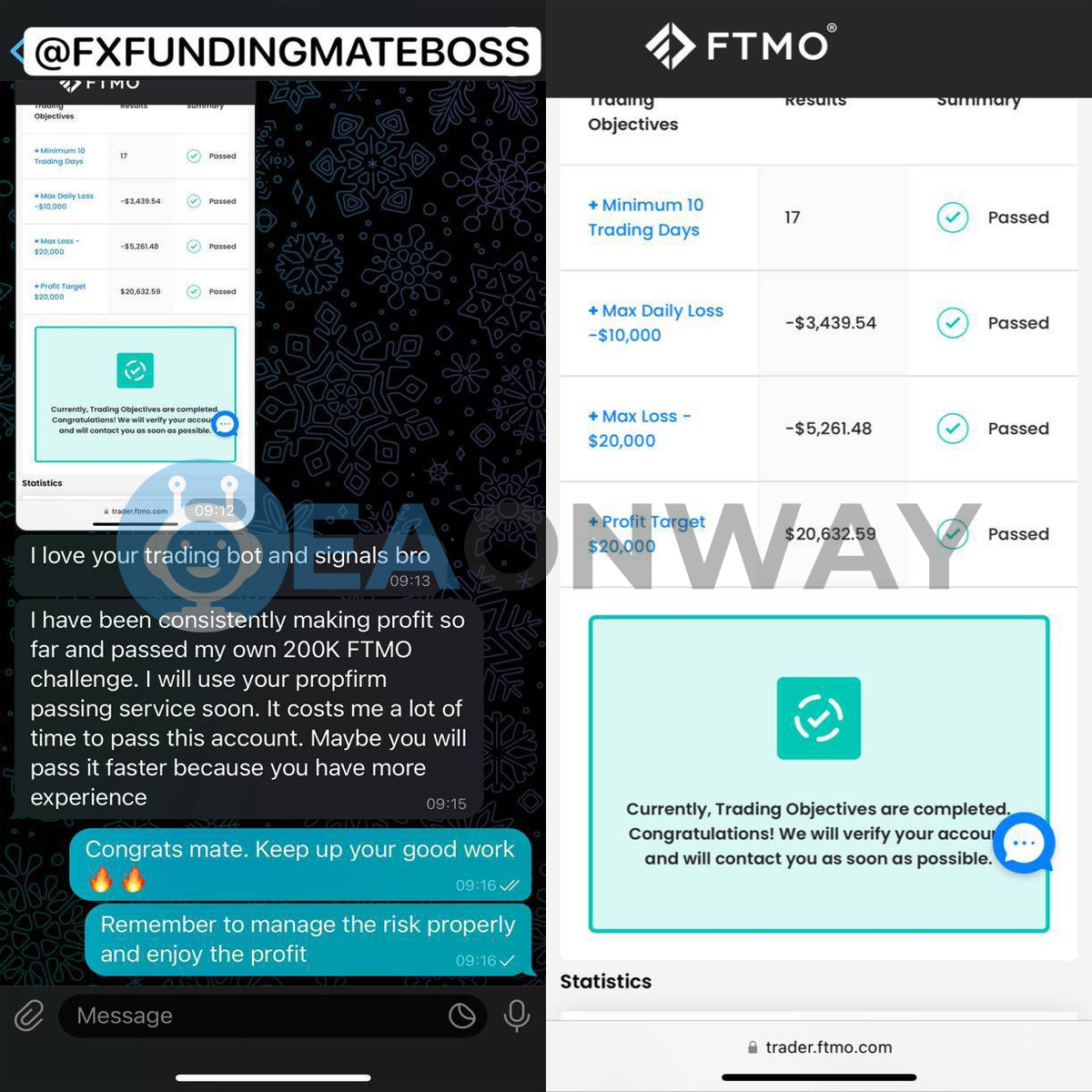

FXFUNDINGMATE PROPFIRM EA 2.0 is an automated trading system specifically designed to help traders pass proprietary firm challenges like FTMO, demonstrating remarkable success by completing a $100,000 FTMO challenge in just 3 days.

This EA achieved a profit target of $20,632.59 (103% of required target) while maintaining strict risk parameters with maximum daily loss of only $3,439.54 against a $10,000 limit. Built with integrated drawdown protection and ATR-based stop losses, it focuses on trend analysis strategies to deliver consistent performance under prop firm evaluation conditions.

Key Takeaway

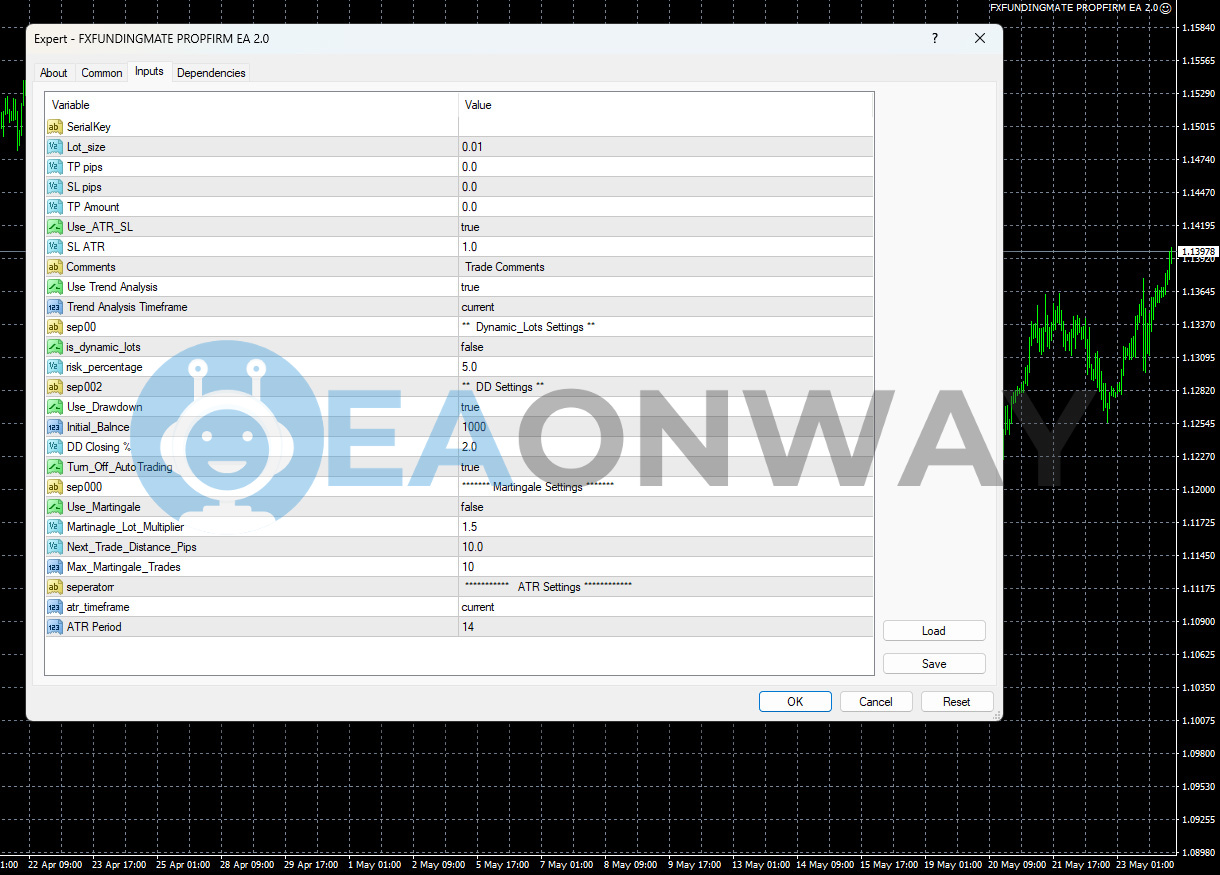

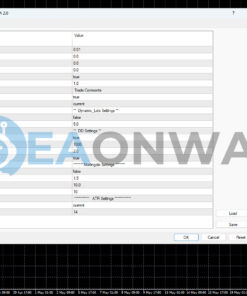

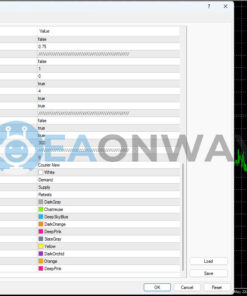

Overview: Advanced automated trading system with comprehensive risk management settings, customizable lot sizing, and built-in drawdown protection specifically optimized for prop firm challenge requirements.

Trading Strategy and Algorithm:

- Core Strategy: Utilizes trend analysis on current timeframe to identify directional trading opportunities aligned with prevailing market momentum

- Key Elements: ATR-based dynamic stop losses (14-period ATR), current timeframe trend confirmation, and profit target optimization without fixed pip targets

- Risk Framework: Integrated 2% drawdown protection with auto-trading shutdown, optional Martingale system (disabled by default), and dynamic lot sizing based on risk percentage

Key Benefits and Trade-offs:

• Rapid Challenge Completion: Proven 3-day FTMO success rate, though performance may vary significantly in different market conditions or with other prop firms

• Low Drawdown Control: Built-in 2% maximum drawdown protection with auto-shutdown, but this conservative approach may limit profit potential during favorable market runs

• Flexible Risk Management: ATR-based stops and customizable lot sizing, requiring proper parameter optimization for different account sizes and market volatility

• Trend-Following Efficiency: Systematic trend identification reduces emotional trading decisions, but may underperform during ranging or highly volatile market periods

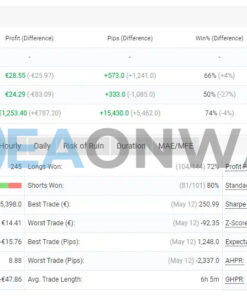

Verified Performance Data:

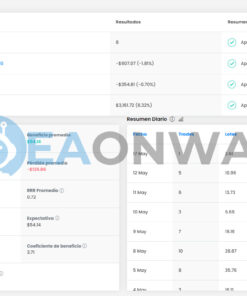

• FTMO Challenge Results: 103.16% profit target achievement ($20,632.59 from $20,000 target) with maximum drawdown of 5.26% against 20% limit

• Risk Metrics: Maximum daily loss of $3,439.54 (34% of allowed $10,000 limit), demonstrating strong daily risk control

• Trading Consistency: Completed minimum 10 trading days requirement with 17 actual trading days, showing systematic approach

Primary Risks: Strategy heavily optimized for prop firm challenge conditions may not translate identically to long-term live trading; trend-following approach vulnerable during choppy, ranging markets requiring careful timeframe selection and parameter adjustment.

Recommendations for FXFUNDINGMATE PROPFIRM EA 2.0

For detailed setup instructions and to optimize its performance, please refer to our comprehensive settings guide for the FXFUNDINGMATE PROPFIRM EA 2.0.

• Trading Platform: Compatible with MetaTrader platforms (suitable for general use with MT4 Expert Advisors; specific version for this EA not specified in documentation, user verification recommended)

• Pairs: Currency pair information not provided – requires testing and optimization for specific pairs

• Supported Accounts: Standard and ECN account types recommended – verify broker compatibility before deployment

• Timeframe: Uses “current” chart timeframe for analysis – optimization needed for specific timeframes based on market conditions

• Trading Time: No specific trading session restrictions mentioned – monitor performance during different market hours

• Leverage: Leverage requirements not specified – use conservative leverage ratios as higher leverage amplifies both potential profits and potential losses significantly

• Minimum Deposit: Designed for $100,000 FTMO challenge accounts – smaller accounts may require parameter adjustments and higher capital recommended for better risk distribution with this trend-following strategy

FXFUNDINGMATE PROPFIRM EA 2.0 Review

This EA demonstrates solid prop firm challenge performance with proven FTMO success, though its heavy optimization for challenge conditions may not guarantee identical long-term results. Best suited for traders specifically targeting prop firm evaluations who prioritize strict risk control over maximum profit potential.

FTMO Challenge Results Snapshot:

• Profit Achievement: $20,632.59 (103.16% of target) – exceeded minimum requirement while maintaining conservative risk approach

• Risk Management: Maximum daily loss $3,439.54 vs $10,000 limit (66% safety margin) – demonstrates excellent daily risk control but may indicate overly conservative approach during favorable conditions

• Trading Consistency: 17 trading days vs 10 minimum requirement – systematic execution with built-in safety margins

Why Choose FXFUNDINGMATE PROPFIRM EA 2.0

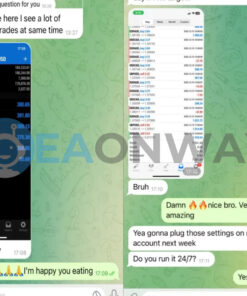

• Proven Prop Firm Success: Demonstrated ability to pass FTMO challenges with documented results, though success timing (3 days) may not be replicable in all market conditions or challenge attempts

• Built-in Safety Systems: Comprehensive drawdown protection and auto-trading shutdown prevents catastrophic losses, but conservative 2% limit may restrict profit potential during strong trending periods

• Flexible Risk Configuration: Multiple risk management options including ATR stops and dynamic lot sizing allow customization, requiring proper parameter optimization to match individual risk tolerance and account size

• Trend-Following Clarity: Systematic approach removes emotional decision-making and provides clear trading logic, while remaining vulnerable to whipsaw losses during ranging market conditions

• Challenge-Specific Design: Unlike generic EAs, this system targets specific prop firm requirements and objectives, though this specialization may limit effectiveness in regular live trading scenarios

Conclusion

FXFUNDINGMATE PROPFIRM EA 2.0 offers a specialized solution for prop firm challenges with proven FTMO success and robust risk controls, but its challenge-optimized design may not suit long-term live trading or ranging market conditions.

Ideal for traders specifically targeting prop firm evaluations who prioritize risk management over aggressive profit maximization, while requiring careful parameter adjustment and realistic expectations beyond initial challenge success.

Get FXFUNDINGMATE PROPFIRM EA 2.0 now!

• Telegram: https://t.me/+E2r7ipeuS6BjNzFl

• Email: [email protected]

FFM PROPFIRM EA MT4 Download Packages:

- Link download experts:

- FFM PROPFIRM EA MT4.ex4

- Presets:

FAQs

What is the FXFUNDINGMATE PROPFIRM EA MT4 designed for?

What trading strategy does the FFM PropFirm EA use?

Does it have built-in risk management features?

What kind of performance has this EA shown in prop firm challenges?

Is this EA suitable for live trading accounts beyond challenges?

What is the minimum deposit recommended to use it effectively?

Which trading platform is it compatible with?

Does this EA use Martingale or Grid strategies?

Where can I find setup instructions or recommended settings?

Who is this EA best for?

Reviews

There are no reviews yet.