-96%

Market Reversal Alerts EA MT4 with Setfiles

Original price was: $899.00.$39.99Current price is: $39.99.

Market Reversal Alerts EA MT4: Detect and trade market structure shifts and reversals automatically. Smart filters across multiple timeframes with customizable risk management for MT4 traders seeking structure-based opportunities.

✓

Verified Original & Safe

✓

Instant Download After Purchase

✓

Free Updates for Future Versions

✓

Free Dedicated Remote Support

✓

Unlimited Activations on Your Accounts

✓

Money-Back Guarantee (Details)

Secure Checkout

Table of Contents

Market Reversal Alerts EA v2 Review: Smart Structure-Based Trading

What is Market Reversal Alerts EA?

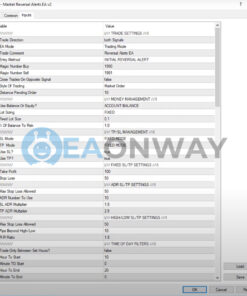

Market Reversal Alerts EA is a highly customizable MT4 expert advisor designed to identify and trade potential market reversals by detecting exhaustion in trends and shifts in market structure. The EA builds upon the Market Reversal Alert Indicator to automatically execute trades at key market structure points, offering traders a systematic approach to capturing reversals and significant pullbacks.

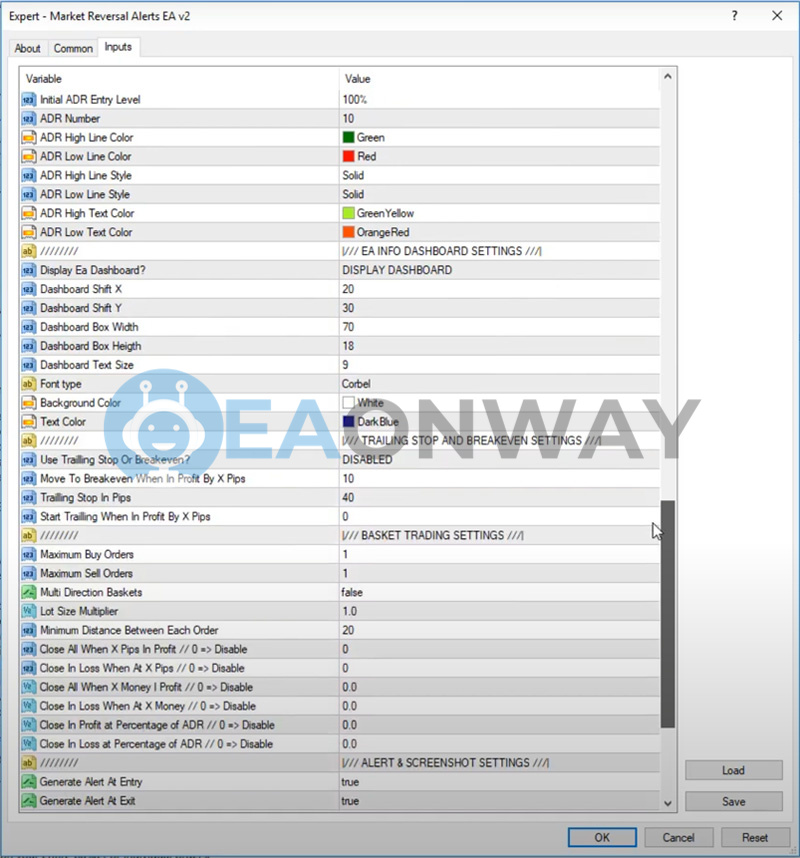

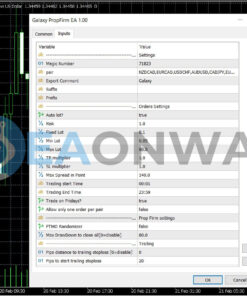

For detailed setup instructions and to optimize its performance, please refer to our comprehensive settings guide for the Market Reversal Alerts EA v2.

Key Takeaway

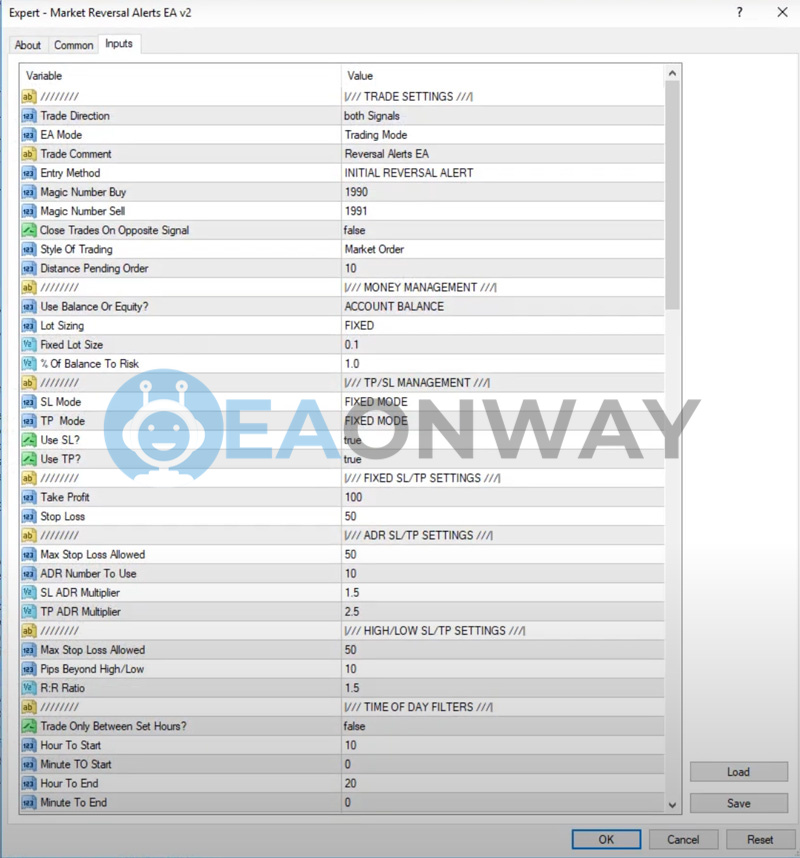

- Core Strategy: Trades market structure shifts by detecting trend exhaustion and price action reversals, with options to trade initial reversals or retest signals.

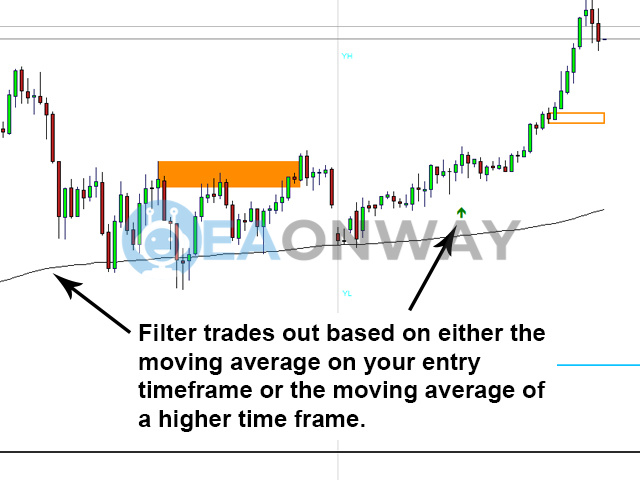

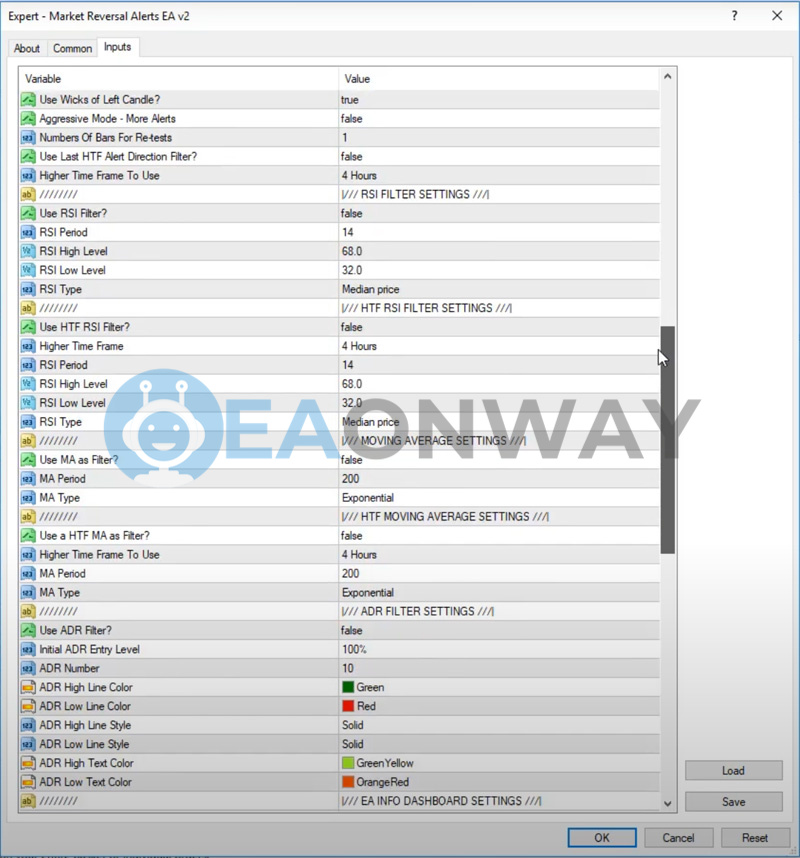

- Key Indicators & Logic: Combines market structure analysis, price momentum tracking, and optional filters including RSI, Moving Averages, and Average Daily Range (ADR) across multiple timeframes.

- Customization Power: Features extensive parameter options allowing traders to tailor the EA to their specific trading style, with special adaptability for those trading smart money concepts and stop hunts.

- Risk Management: Offers multiple risk control mechanisms including fixed/dynamic stop loss options, trailing stops, breakeven functionality, and percent-based position sizing—though effective use requires understanding the underlying market structure concepts.

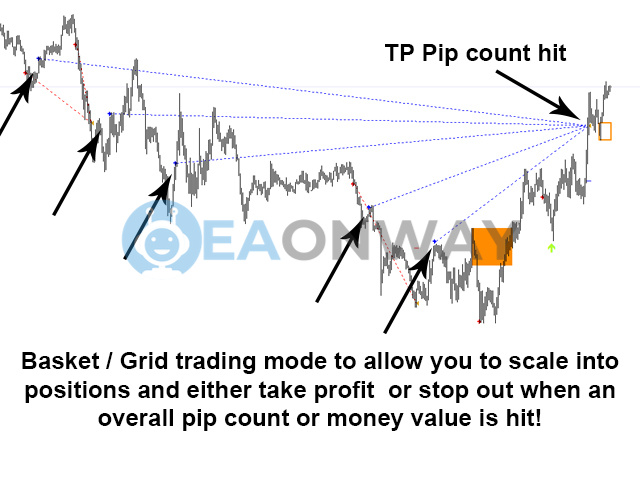

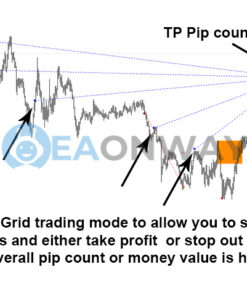

- Trading Modes: Provides flexibility between single-entry trades and basket/grid trading mode for scaling into positions, though basket trading increases potential drawdown risk if improperly configured.

- Primary Limitations: Not a “set-and-forget” system—requires time investment to understand the trading logic and customize settings appropriately; may produce false signals during strong trend continuations.

Recommendations for Market Reversal Alerts EA

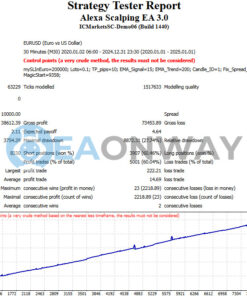

- Trading Platform: MetaTrader 4 (MT4)

- Pairs: Any currency pair

- Timeframes: Any chart timeframe, with capability to incorporate higher timeframe filters

- Trading Style: Reversal trading with market structure analysis

- Optimal Settings: Customize based on preferred risk tolerance and trading style; adaptive filters recommended for reducing false signals

- Leverage: 1:100 or lower recommended; higher leverage significantly increases both profit potential and risk exposure

- User Experience: Intermediate to advanced traders will benefit most due to the EA’s sophisticated configuration options

Market Reversal Alerts EA Review

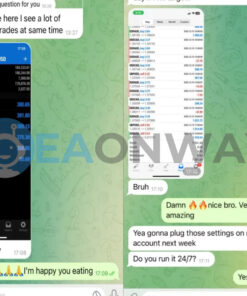

Market Reversal Alerts EA delivers a robust framework for trading market structure shifts and reversals, balancing automated execution with extensive customization. It’s ideally suited for technical traders who understand price action concepts and are willing to invest time in mastering its parameters. While offering powerful trend-shift detection capabilities, success requires proper configuration and realistic expectations about reversal trading dynamics.

The EA includes a comprehensive dashboard display option with customizable visual elements to monitor trading activity and performance metrics directly on the chart.

Why Choose Market Reversal Alerts EA

- Structure-Based Trading Logic: Detects genuine shifts in market structure rather than relying solely on lagging indicators, though requires patience as reversals need time to develop and confirm.

- Multi-Layered Filtration: Combines RSI, moving average, and ADR filters across multiple timeframes to improve signal quality, but requires testing to find optimal filter combinations for specific trading conditions.

- Trader-Adaptive Framework: Can be configured for aggressive or conservative trading approaches through parameter adjustments, allowing alignment with your risk tolerance—but necessitates careful testing before live deployment.

- Comprehensive Risk Controls: Features fixed, ADR-based, and market structure-based stop loss options plus trailing stop functionality, though proper risk per trade settings remain essential regardless of EA sophistication.

- Smart Money Concept Integration: Offers options to specifically trade “stop hunts” (sweeps of previous day’s highs/lows), providing an edge for traders familiar with institutional trading patterns, while requiring deeper market understanding than typical indicator-based systems.

Conclusion

Market Reversal Alerts EA offers a sophisticated framework for traders seeking to automate market structure trading with extensive customization. Best suited for intermediate-to-advanced traders willing to invest time in setup and understanding the underlying strategy. While potentially powerful for capturing reversals, users should approach with realistic expectations about the inherent challenges of trading against dominant market direction.

Get Market Reversal Alerts EA now!

- Telegram: https://t.me/+E2r7ipeuS6BjNzFl

- Email: [email protected]

Market Reversal Alerts EA MT4 Download Packages:

- Link download experts:

- Market Reversal Alerts EA MT4.ex4

- Presets:

FAQs

What trading strategy does the Market Reversal Alerts EA MT4 use?

What are the main benefits of using the Market Reversal Alerts EA MT4?

How does it manage risk?

Can it use grid or martingale strategies?

Which trading platform is it compatible with?

What's the recommended leverage and minimum capital?

How do I find the optimal settings for this EA?

Is this trading bot suitable for beginners?

What are the potential downsides or limitations I should be aware of?

Where can I get support or purchase the EA?

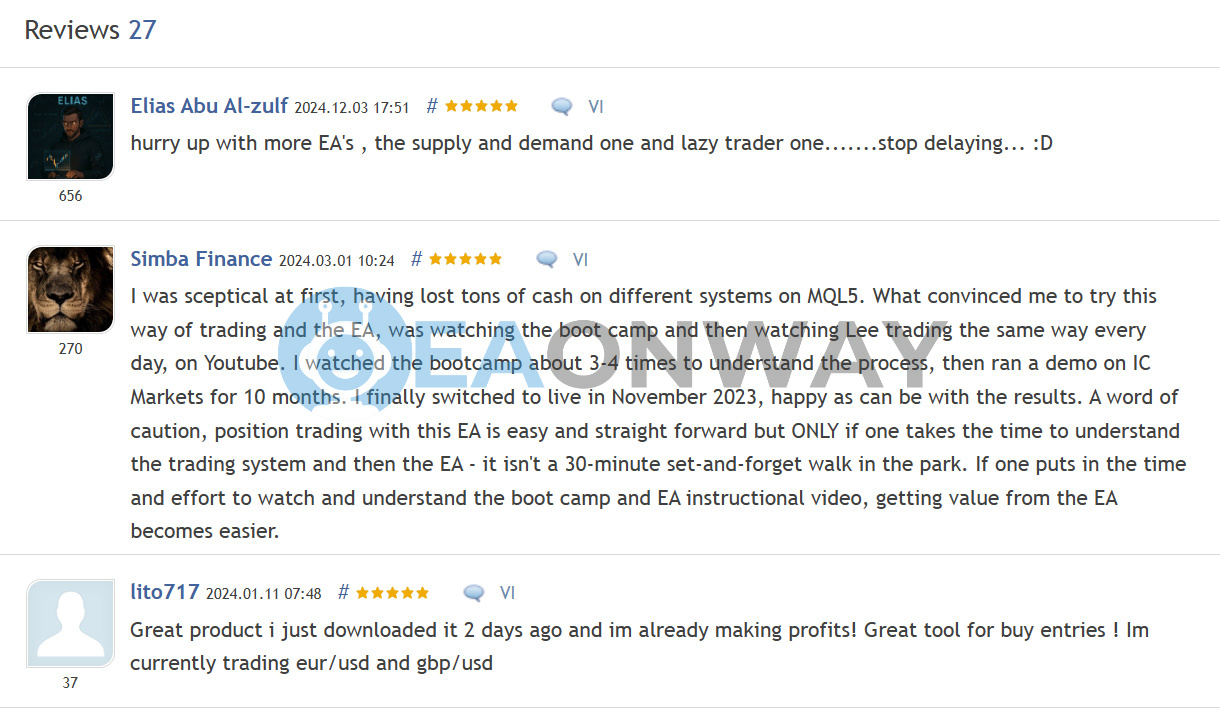

Reviews

There are no reviews yet.