-92%

ORDER BLOCK EA Prop Firm MT4 with Setfiles

Original price was: $499.00.$39.99Current price is: $39.99.

Order Block EA Prop Firm MT4: Institutional order block detection system for passing prop firm challenges with low drawdown. Uses proprietary AFSD PRO™ technology on MT4 platform.

✓

Verified Original & Safe

✓

Instant Download After Purchase

✓

Free Updates for Future Versions

✓

Free Dedicated Remote Support

✓

Unlimited Activations on Your Accounts

✓

Money-Back Guarantee (Details)

Secure Checkout

Table of Contents

What is Order Block EA Prop Firm MT4?

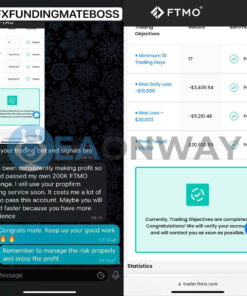

Order Block EA Prop Firm MT4 is an automated trading system designed specifically to detect institutional order block zones and execute trades based on these key price levels. The EA is optimized for passing proprietary trading firm challenges with its low drawdown approach while capitalizing on institutional price reactions.

Key Takeaway

- Core Strategy: The EA identifies and trades order blocks—price zones with significant orders from banks or major institutions that act as key support and resistance levels. It executes trades based on anticipated price reactions to these detected zones.

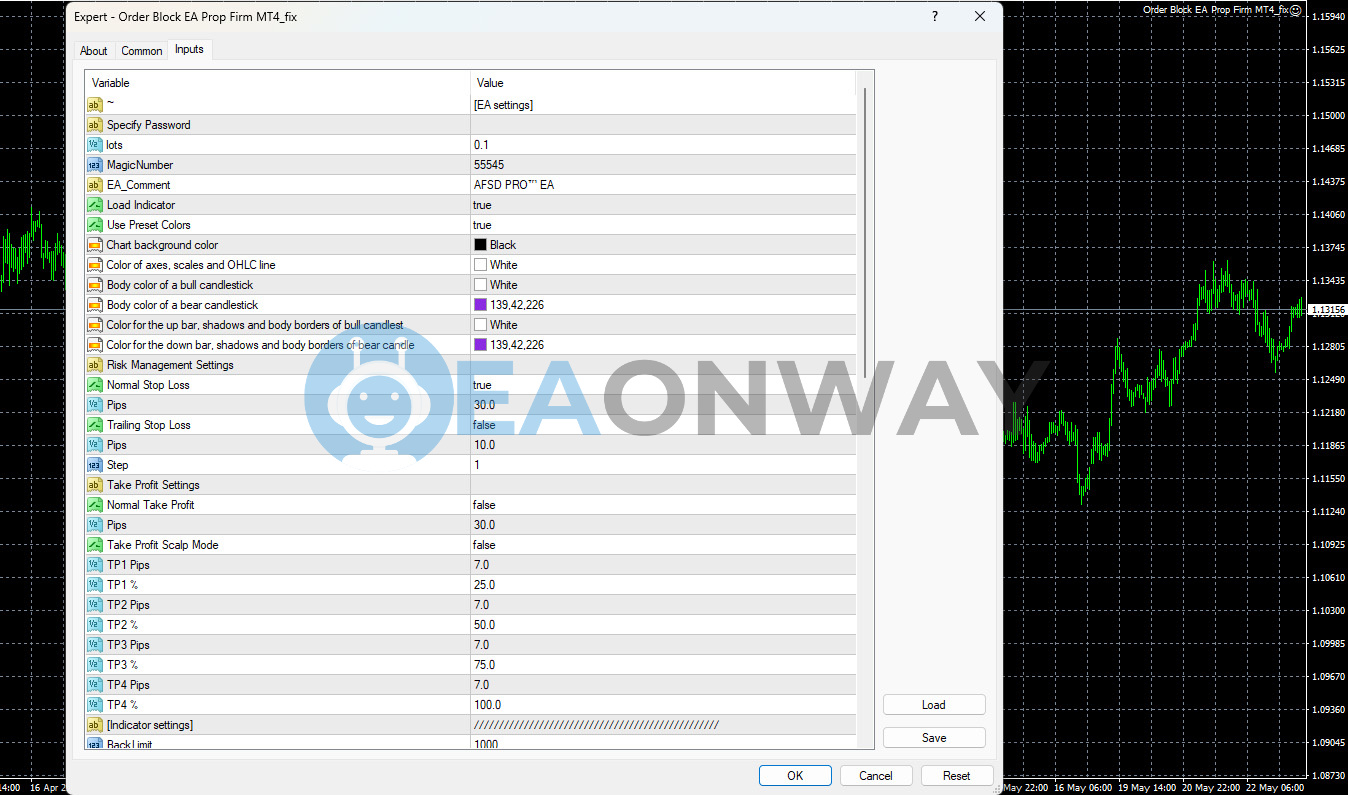

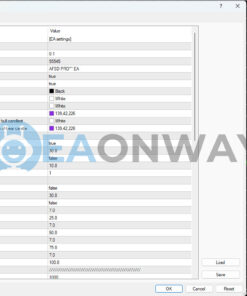

- Trading Mechanism: Utilizes proprietary algorithms to detect order blocks combined with supply and demand zone analysis. The EA’s “AFSD PRO™” engine works alongside the included Channel Surfer indicator to identify high-probability trading opportunities.

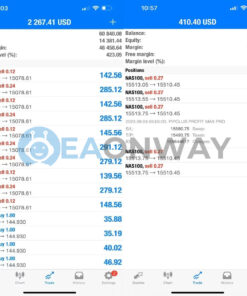

- Low Drawdown Focus: Designed to maintain controlled risk exposure with comprehensive stop loss mechanisms (both normal and trailing options), making it suitable for prop firm challenges that strictly monitor drawdown metrics. This controlled approach may limit potential profits in some volatile market conditions.

- Performance Metrics: Backtest results for FTMO 200K challenge showed 22,192.60 profit with 3.94% max drawdown; FTMO 100K challenge showed 11,692.00 profit with 3.69% max drawdown; and FTMO 10K challenge showed 10,471.64 profit with 3.15% max drawdown. While these results are promising, backtests may not account for all real market variables.

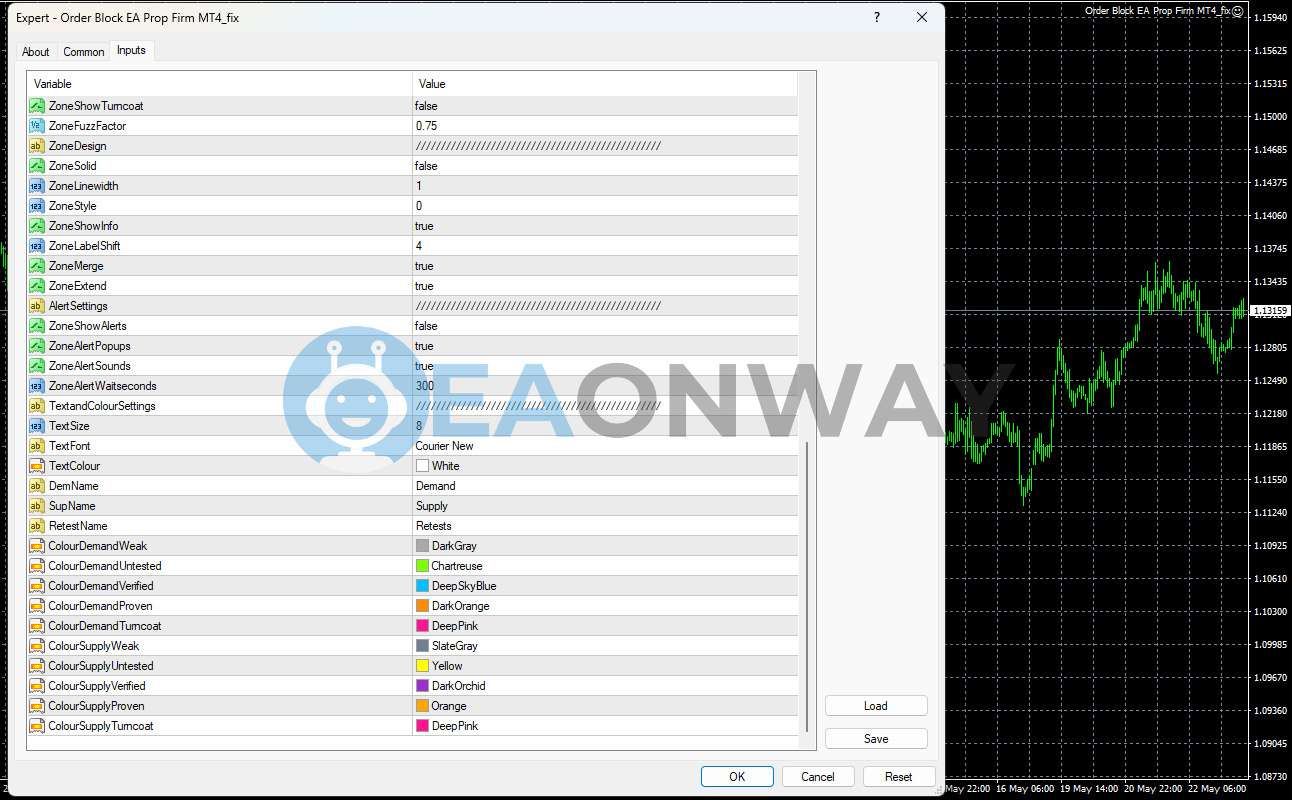

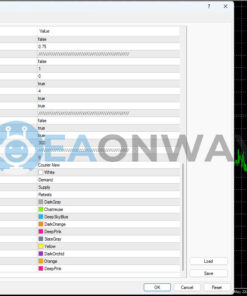

- Customization Options: Offers extensive parameter settings including zone visualization controls, risk management configurations, and preset files for different account sizes (10K, 25K, 50K, 100K, 200K). However, improper configuration could lead to suboptimal performance or increased risk exposure. For detailed setup instructions and to optimize its performance, please refer to our comprehensive settings guide for the Order Block EA Prop Firm MT4.

- Primary Risk: The EA’s performance heavily depends on accurate order block identification. During unusual market conditions or high-impact news events, these zones may become less reliable, potentially leading to unexpected losses despite the built-in risk management features.

Recommendations for Order Block EA Prop Firm MT4

- Trading Platform: MetaTrader 4 (MT4)

- Pairs: Any pairs including major, minor, or exotic currency pairs. More exotic pairs may exhibit higher spreads that could impact performance.

- Timeframes: M15 or H1 timeframes recommended for optimal performance

- Minimum Deposit: $10,000 recommended (primarily designed for prop firm accounts). A higher balance allows better risk distribution across multiple trades.

- Risk Settings: Adjustable stop loss (default: 30 pips) and take profit parameters with optional trailing stop functionality. For consistent performance, avoid reducing stop loss values below recommended presets.

- Preset Files: Multiple preset files included for different account sizes (10K, 25K, 50K, 100K, 200K) and instruments (FX, Gold)

- Leverage: While the EA works with standard leverage, lower leverage (1:30 or less) is recommended for prop firm challenges to ensure safer risk profile. Higher leverage will amplify both potential profits and losses.

Order Block EA Prop Firm MT4 Review

This EA offers a specialized approach to institutional order block trading with impressive backtest results across multiple prop firm challenge scenarios. While the win rates and profit factors look promising, users should maintain realistic expectations about performance consistency across varying market conditions.

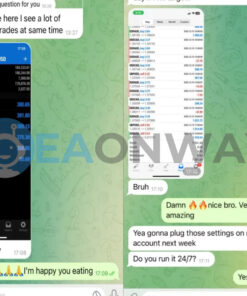

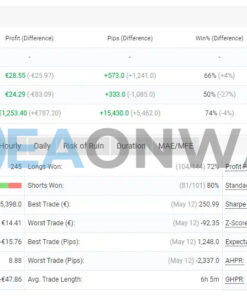

FTMO 200K Challenge Results:

- 22,192.60 total net profit with 3.94% maximum drawdown

- 57 total trades with 71.93% profitable trades

- Average profit trade: 628.26 / Average loss trade: -221.64

FTMO 100K Challenge Results:

- 11,692.00 total net profit with 3.69% maximum drawdown

- 655 total trades with 73.43% profitable trades

- Profit factor: 1.54

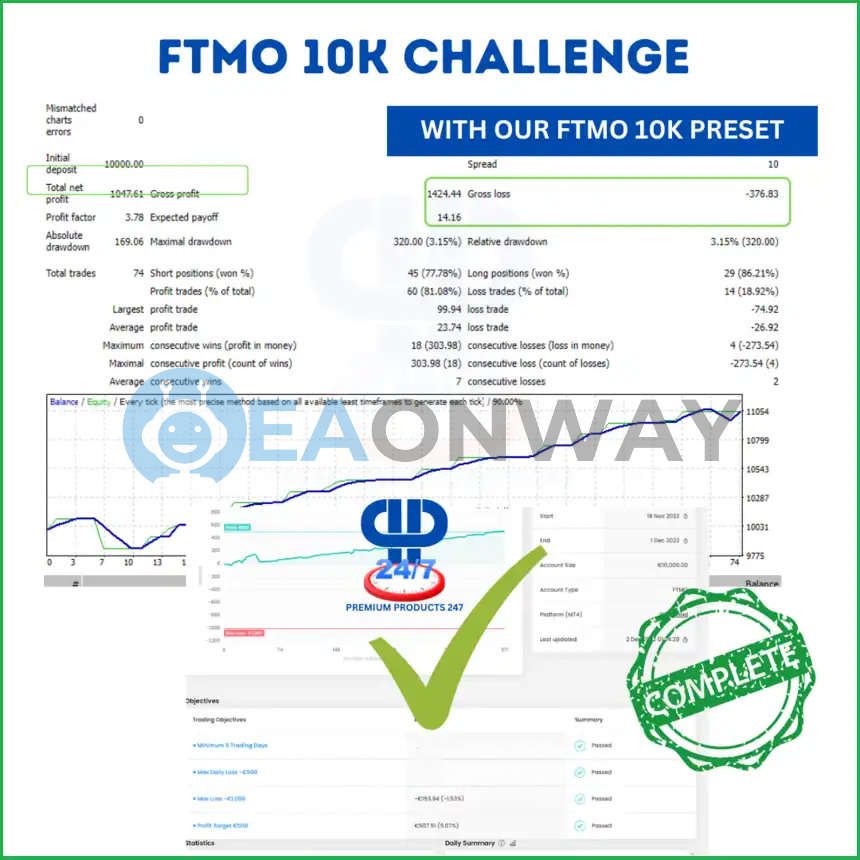

FTMO 10K Challenge Results:

- 10,471.64 total net profit with 3.15% maximum drawdown

- 74 total trades with 81.08% profitable trades

- Profit factor: 3.78

Why Choose Order Block EA Prop Firm MT4

- Prop Firm Optimization: Specifically designed to help traders pass proprietary trading firm challenges with controlled drawdown parameters, though actual performance may vary based on specific market conditions and challenge rules.

- Order Block Technology: Capitalizes on institutional order flow zones where price is likely to react, providing a structured approach to market analysis rather than relying on lagging indicators. However, the effectiveness depends on market liquidity and volatility conditions.

- Comprehensive Package: Includes the main EA, supplementary tools (AF Supply and Demand EA 2025), Channel Surfer indicator, and multiple presets for different account sizes. This requires some learning curve to utilize all components effectively.

- Time-Saving Automation: Eliminates the need for manual order block identification and trade execution, freeing traders from constant screen time while maintaining disciplined trading. Regular monitoring is still recommended for optimal performance.

- Low Drawdown Profile: Maintains relatively small drawdowns (around 3.15-3.94% in backtests) while generating consistent returns, though this conservative approach may limit potential profits during strong trending markets.

Conclusion

Order Block EA Prop Firm MT4 offers a specialized solution for traders seeking to pass prop firm challenges through automated order block trading strategies. Best suited for disciplined traders with intermediate Forex knowledge who value controlled risk over aggressive profits. Those seeking more aggressive returns or traders without understanding of institutional price action concepts may find the conservative approach limiting.

Get Order Block EA Prop Firm MT4 now!

- Telegram: https://t.me/+E2r7ipeuS6BjNzFl

- Email: [email protected]

ORDER BLOCK EA Prop Firm MT4 Download Packages:

- Link download experts:

- ORDER BLOCK EA Prop Firm MT4.ex4

- Presets:

FAQs

What is the Order Block EA Prop Firm MT4, and what strategy does it employ?

How is the Order Block EA Prop Firm MT4 specifically optimized for prop firm challenges?

What kind of performance has this EA shown in backtests for prop firm accounts?

How does the EA manage risk? Does it use a Stop Loss, and does it use Grid or Martingale strategies?

What trading platform is required, and what are the recommended pairs and timeframes for this system?

What is the minimum deposit needed, and what leverage settings are advised for its use?

Does it come with preset files, and how can I access detailed setup instructions?

What are the main risks or limitations I should be aware of when using this trading tool?

Who would benefit most from using this automated trading system?

Reviews

There are no reviews yet.